Market and Economic Outlook - Released 9/30/19

Key takeaways

- We feel we are in the later innings of the economic expansion but given the strength of the U.S. consumer we don’t feel a recession is likely over the next few quarters.

- The low interest rate environment makes it difficult for high quality bonds to earn a return above inflation but remain an important diversifier against stock market risk.

- We continue to seek pockets of opportunities but are applying a neutral approach to multi asset portfolios as neither stocks or bonds appear cheap.

Market forecasters have been describing the state of the U.S. economy in baseball terms lately. It has become a common phrase to say we are in the later innings of the economic cycle. In other words, the U.S. economic expansion is headed for the 9th inning and fans are starting to head for the exits. The current period of economic growth in the U.S. is already the longest in history so it has been safe to say we are late in the expansion. However, in our view we don’t see a recession in the next few quarters and feel this “game” may be headed for extra innings.

Trade tensions continue

We feel trade is likely to remain a major player as we head into 2020. The trade dispute between the U.S. and China continued to dominate the markets and drive investor sentiment which moved frequently and forcefully from positive to negative. A truce between President Trump and China’s President Xi Jinping at the start of the quarter was undone when the U.S. announced higher tariffs on Chinese goods mid-August. China responded by imposing their own tariffs on U.S. goods and devaluing their currency making U.S. goods relatively more expensive. As quickly as it escalated, the rhetoric then softened with conciliatory statements from both parties, a delaying of announced tariffs, and the confirmation of a meeting in October. Overshadowed by all the trade headlines, predominantly positive economic data continued to roll in all quarter showing the U.S. remained on a slow growth trajectory.

Consumer a bright spot

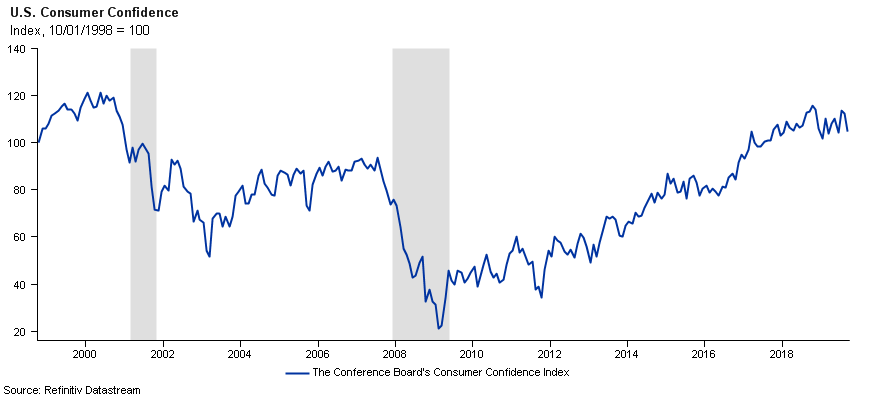

Consumer confidence, which has peaked six months or more before the last two recessions, is currently near the high for this expansion (Figure 1). According to the U.S. Census Bureau, retail sales remain robust and were up 4% year over year in August. Since consumer consumption makes up roughly 2/3rds of U.S. GDP, both consumer confidence and spending are important data points for assessing the economy. Given the confidence of the U.S. consumer we don’t feel a recession is likely at least over the next few quarters.

Figure 1

Figure 1

U.S. stock market resilient

Despite some good economic data, the U.S. bond market seems to be playing by different rules than U.S. stocks. Within bonds, the 3-month Treasury yield is higher than the 10-year yield creating an inverted yield curve. This can be a possible signal of a recession. U.S. stocks on the other hand recovered from a volatile August and the S&P 500 is trading near its record high at quarter end.

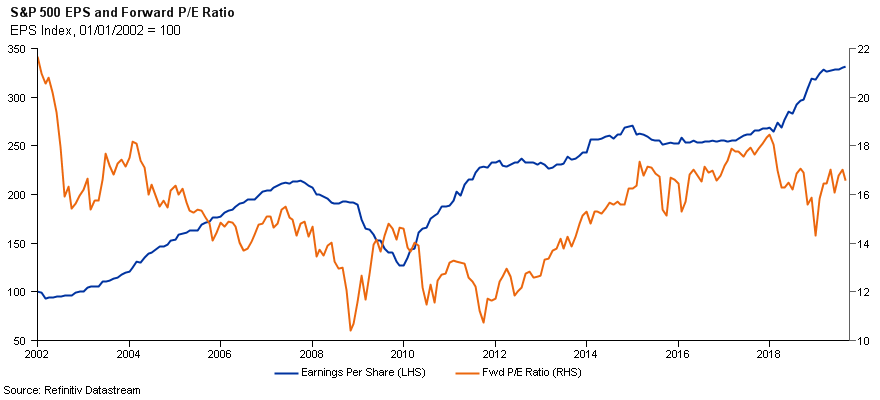

Industry consensus says the S&P 500 earnings level is projected to reach new highs next year, but the growth rate has slowed (Figure 2). Corporate margins are benefiting from low borrowing costs as well as favorable corporate income tax rates courtesy of the Tax Cuts and Jobs Act of 2017. This seems to be priced in as the forward price-to-earnings ratio for the S&P 500 as of the end of September is slightly above its historical average.

Figure 2

Figure 2

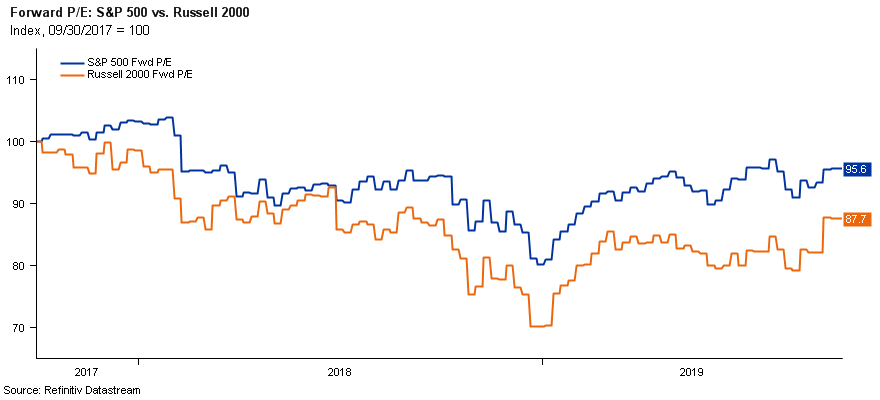

Generally, small-cap stocks in the U.S. have lagged large-cap companies over the last year as investors have flocked to larger companies for their perceived safety. We feel this has created an opportunity as most small-caps have become attractively priced relative to large-caps (Figure 3).

Increasing geopolitical risks and slowing growth also reinforce our neutral view between domestic and international stocks. Outside of the U.S., our favorable outlook on emerging market stocks relative to developed market stocks has narrowed. Despite attractive valuations, near term risks like dollar strength and the unresolved trade disputes persist.

Figure 3

Figure 3

No relief for low rates

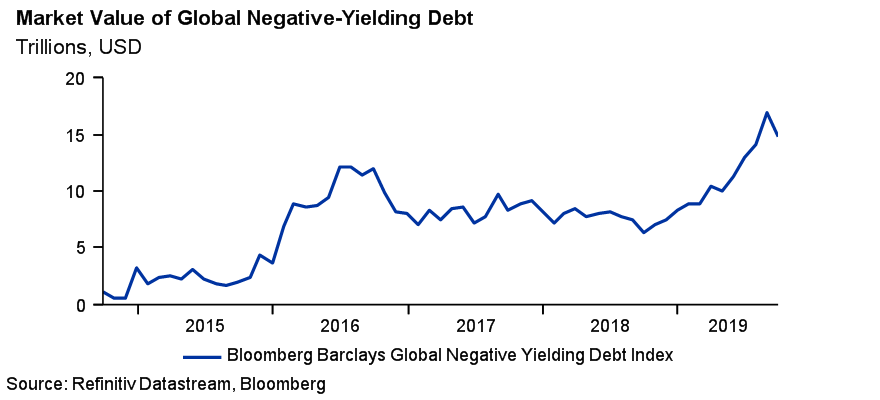

It is interesting to note a yield curve inversion has preceded every recession, but not every inversion has led to a recession. Some believe U.S. bond markets are signaling the Federal Reserve raised rates too high and additional cuts will be needed to avoid a global economic slowdown. Many foreign countries continue to rely on their own monetary policy to reinvigorate growth through interest rate cuts and bond purchases, as opposed to fiscal stimulus. This bond buying creates artificial demand in the global marketplace creating almost $15 trillion in global negative-yielding debt in September (Figure 4). Even including hedging costs, U.S. bonds look compelling to foreign investors keeping demand high and a lid on our rates.

Figure 4

Figure 4

There are likely other economic factors causing the low interest rates. Technological advancements in a variety of industries can lead to a displacement of labor limiting wage inflation. An aging population spends less and saves more leading to a possible savings glut. Many investors would rather lock up their money safely at today’s low yields to help ensure it will be there when they need it. Demand from pension funds and other institutional investors for safe income producing investments remains high.

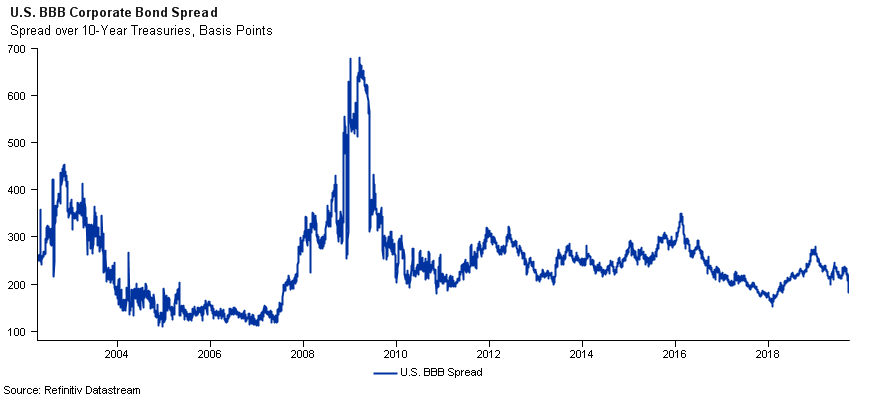

While U.S. Treasury rates are low, some investors lean towards riskier bonds to get higher yields. However, the difference in yields paid by corporations to borrow money vs. safer U.S. Treasuries remains tight (Figure 5). This is a sign corporate profitability is sound but also means bond investors aren’t getting paid much to take risk.

Figure 5

Figure 5

The low interest rate environment makes it difficult for high quality bonds to earn a return above inflation but in our view, they remain an important diversifier against stock market risk. We are not abandoning high quality bonds, even in a low interest rate environment.

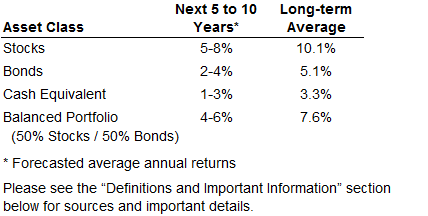

We continue to seek pockets of opportunities but have a neutral approach to multi asset portfolios as neither stocks or bonds appear cheap.

The bottom line

We agree this economic expansion is in the later innings, but there are enough positives for us to feel confident a recession is not likely in the near term. Trade tensions, Fed interest rate decisions and political risk may cause investors to focus on short term headlines and stay on the sidelines. However, for our long-term approach, we continue to believe ignoring the noise and staying diversified is the best strategy if things get tense during the later innings.

Figure 6

Figure 6

COUNTRY Trust Bank wealth management team

- Troy Frerichs, CFA - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Molly Ruddy - Investment Associate

- Chelsie Moore, CFA, CFP® - Manager, Wealth Management

- Jeff Hank, CFA, CFP® - Portfolio Manager

- Weston Chenoweth - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

Definitions and Important Information

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

The federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. The Federal Open Market Committee, which is the primary monetary policymaking body of the Federal Reserve, sets its desired target range.

The yield curve plots the interest rates of similar-quality bonds against their maturities. The most common yield curve plots the yields of U.S. Treasury securities for various maturities. An inverted yield curve occurs when short-term rates are higher than long-term rates.

The price-to-earnings ratio is a valuation ratio which compares a company's current share price with its earnings per share (EPS). EPS is usually from the last four quarters (trailing P/E), but sometimes it can be derived from the estimates of earnings expected in the next four quarters (projected or forward P/E). The ratio is also sometimes known as "price multiple" or "earnings multiple."

Figures 1,2,3,5: Chart data comes from Thomson Reuters Datastream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis.

Figure 4: Chart data comes from Bloomberg a major global provider of 24-hour financial news and information, including real-time and historic price data, financials data, trading news, and analyst coverage, as well as general news and sports.

Figure 6: The long-term average return data comes from Morningstar and is based upon compound average annual returns for the period from 1926 through May 31, 2019. Stocks are represented by the Ibbotson® Large Company Stock Index, which is comprised of the S&P 500® Composite Index from 1957 to present, and the S&P 90® Index from 1926 to 1956. Bonds are represented by the Ibbotson® U.S. Intermediate-Term Government Bond Index. Cash Equivalents are represented by the 30-day U.S. Treasury bill. The “Balanced Portfolio” is representative of an investment of 50% stocks and 50% bonds rebalanced annually. Forecasted stock returns include small capitalization and international equities. Forecasted bond returns include investment grade corporate bonds. These returns are for illustrative purposes and not indicative of actual portfolio performance. It is not possible to invest directly in an index.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

Stocks of mid-capitalization companies may be slightly less volatile than those of small-capitalization companies but still involve substantial risk and they may be subject to more abrupt or erratic movements than large capitalization companies.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity and volatile prices.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher-rated securities.

Sector investments tend to be more volatile than investments that diversify across companies in many sectors.