Special Report - Post Election 2020 - Released 11/11/20

Key takeaways

- Historically, divided government has been a positive for financial markets.

- An effective COVID-19 vaccine can return the global economy to a more normal environment during 2021.

- An economic recovery could benefit U.S. small and mid-cap stocks and international stocks.

- Support from the Federal Reserve may provide attractive opportunities in certain segments of the bond market.

- After the unpredictable events this year, it’s clear that time in the markets is more impactful than timing the markets.

In our most recent Market & Economic Outlook, we stated there were signs of an economic recovery underway but with risks lurking beneath the surface. We also expected political gamesmanship along with fears of a third wave of COVID-19 infections to drive investor sentiment as we headed into the U.S. election.

Now, the election results are coming into focus and we’ve received more positive COVID-19 vaccine updates, we believe we have more clarity on the impacts to financial markets. A divided government and a successful vaccine are likely to provide a significantly different investment environment to consider.

Gridlock has been good

This was one of the most closely contested elections in history, and it appears, the country remains divided. Although legal challenges to the election result are likely to continue, the Associated Press has declared a Democrat President and a majority in the House of Representatives, albeit at a narrower margin than before the election. At this point, the Associated Press indicates Republicans are likely to keep their majority in the Senate.

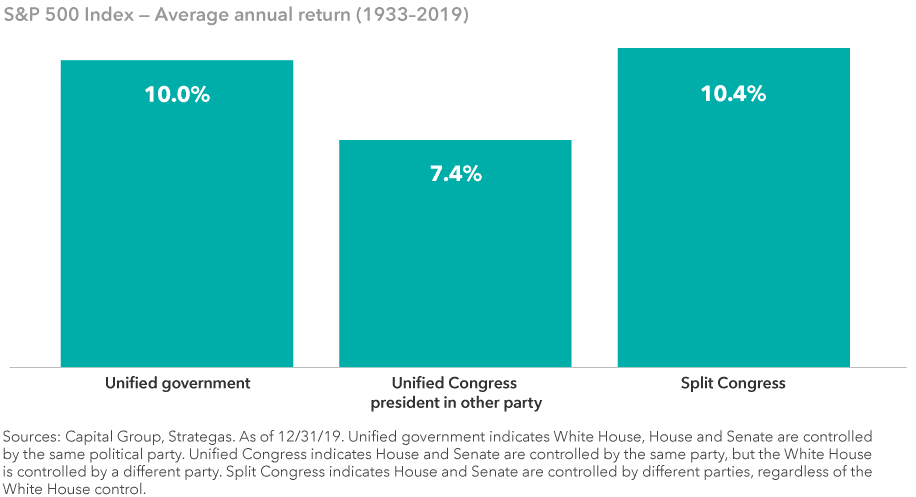

Historically, a divided federal government has been a positive scenario for financial markets, as it likely takes the most extreme policy changes off the table. In fact, according to Capital Group, the S&P 500 Index average annual return has been strongest since 1933 with a divided congress, which many are predicting will occur in January of 2021 (Figure 1).

Figure 1

Figure 1

Sweeping changes to tax rates are unlikely in the near term given the likelihood of political gridlock. However, we may see the expiration of the Tax Cuts and Jobs Act in 2025 if government remains split. Corporate taxes are not scheduled to revert, but individual tax rates would increase. We continue to monitor the impacts on financial markets of changing tax laws.

Vaccine on the way

We also continue to receive positive news on the race for a COVID-19 vaccine. Recently, Pfizer and BioNTech SE announced the vaccine they are developing prevented more than 90% of infections in a study of thousands of volunteers. We feel it is looking more and more like approval of a vaccine will occur later this year. If the vaccine can be proven effective, the U.S. economy could return to a more normal environment during 2021.

Economic recovery continues

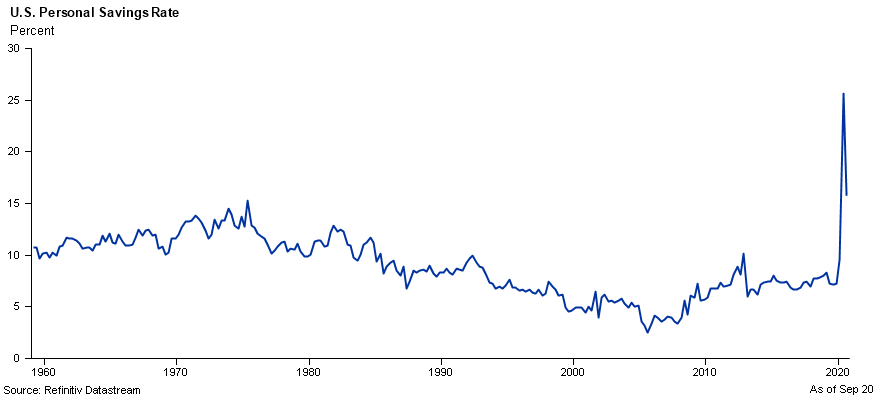

A new fiscal stimulus package remains a possibility and, in our view, would greatly enhance the economy’s ability to weather the coming months until restrictions are finally lifted. In January, the new Congress will be inheriting an economy showing signs of strength. Existing residential home sales rose in September at the highest annual rate since 2006. New residential home construction permit data continues to be robust. Total retail sales in the U.S. have recovered from the April lows despite the pandemic. The U.S. personal savings rates have hit records in 2020 (Figure 2), and there appears to be pent up demand as we believe people will be anxious to go out and spend.

Figure 2

Figure 2

As the world moves closer to reopening, we are likely to see cyclical sectors perform better. An economic recovery powered by a COVID-19 vaccine and additional government stimulus could benefit small and mid-cap stocks. They remain attractive in our view relative to large caps.

We expect a return to globalization and believe trade wars are likely to moderate. President-elect Biden is less likely to implement tariffs when dealing with China. However, it is unlikely the new administration will want to appear weak in trade negotiations. We believe less uncertainty regarding foreign trade could benefit international stocks. We believe non-U.S. stocks look attractive due to attractive valuations, cyclical exposure in an eventual global recovery and possible depreciation of the U.S. Dollar.

Federal Reserve support

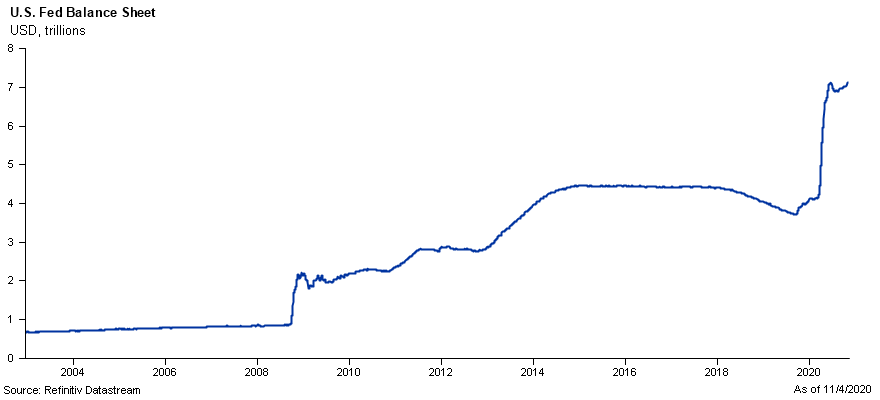

One thing that has remained constant during 2020 is the support the Federal Reserve has provided to financial markets. They have succeeded, so far, in restoring confidence to the markets, keeping interest rates low and enabling credit to flow freely. The Fed is likely to continue their accommodative monetary policies and has stated they are committed to extending their asset purchase program indefinitely. The Federal Reserve’s balance sheet continues to grow currently at $7 trillion in assets. (Figure 3).

Figure 3

Figure 3

Within fixed income markets, we continue to see value in preferred stocks, floating-rate loans, and emerging market debt. These carry higher yields than U.S. investment grade bonds, but are not traditional bond investments, and may contain additional risk. The Fed’s aggressive monetary actions could provide a favorable environment for these types of securities.

Time in the market, not timing the market

In our view, it is better to avoid short term speculation on near term events, and we remain confident in our stance to avoid timing markets heading into elections. Markets may continue to experience fluctuations as COVID-19 cases continue to rise, or if we experience vaccine distribution roadblocks. But after the unpredictable events investors have experienced over the last few weeks and quarters, it’s clear time in the markets is more impactful than timing the markets.

Our team continues to believe the best approach is to focus on personal investing goals instead of market headlines. A trusted financial professional can help you establish a plan able to withstand these changing times.

COUNTRY Trust Bank wealth management team

- Troy Frerichs, CFA - VP, Investment Services

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- G. Ryan Hypke, CFA - Portfolio Manager

- Weston Chenoweth - Investment Analyst

- Molly Ruddy - Investment Analyst

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Jamie Czesak - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

Definitions and Important Information

Figure 1: Chart data comes from Capital Group’s investment newsletter Capital ideas dated November 4, 2020 entitled “What the U.S. election means for investors.”

Figures 2,3: Chart data comes from Refinitiv (formerly Thomson Reuters) Datastream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis.

U.S. existing home sales data obtained from the National Association of Realtors.

Residential construction permit data obtained from the U.S. Census Bureau and Department of Housing and Urban Development.

Retail sales data is obtained through the United States Census Bureau’s website.

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher-rated securities.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

Stocks of mid-capitalization companies may be slightly less volatile than those of small-capitalization companies but still involve substantial risk and they may be subject to more abrupt or erratic movements than large capitalization companies.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity and volatile prices.