COUNTRY Trust Bank® Special Report - Russia Invasion of Ukraine - Released 2/25/22

Key takeaways

- The invasion of Ukraine by Russian forces has added a significant geopolitical risk for investors to navigate. The uncertainty created by this event has added to the risk factors we face in 2022.

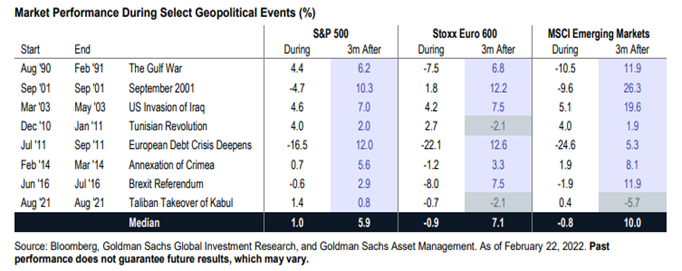

- Recent history has shown that the negative impact of geopolitical events on U.S. market returns has generally been short-lived.

- We continue to monitor Journey Series portfolios and will adjust as needed. We have the flexibility to take advantage of rebalancing opportunities based on market conditions.

The invasion of Ukraine by Russian forces has added a significant geopolitical risk for investors to navigate. The uncertainty created by this event has added to the risk factors we mentioned in our latest Market & Economic Outlook.

These risks included persistent inflation, how the Federal Reserve will address the inflation, the ongoing threat of COVID 19 and its impacts on economic activity, and supply chain disruptions. Economic and financial sanctions imposed on Russian President Vladimir Putin, Russian oligarchs, and its financial system and industries are likely to only exacerbate the inflationary pressures, particularly in energy prices, being experienced globally.

Geopolitical events are unpredictable. We expect markets to remain extremely volatile and investors will be fixated on the current headlines coming from Europe. Investors may adopt a risk-off mentality within financial markets. While we have no idea how long this conflict will last, looking at historical events shows U.S. financial markets have typically recovered quickly from significant geopolitical events (Figure 1).

Our Approach Admidst Uncertainty

We continue to monitor Journey Series portfolios and will adjust as needed. Currently, we believe our portfolios are well positioned and would advise clients not to make significant changes based on the news surrounding this crisis. Within multi asset portfolios, we believe stocks offer long term protection against inflation and remain overweight stocks versus bonds compared to our benchmarks. Investment grade bonds have historically provided ballast during volatile periods for stocks.

We have the flexibility to take advantage of rebalancing opportunities based on market conditions. Focus and Vision accounts are typically rebalanced when a +/-5% deviation from our stock target occurs. CoMPAS is rebalanced on a regular schedule, but we have the flexibility to deviate from this schedule if we deem this is in the best interest of our clients.

Given Russia and Ukraine account for less than 4% of global economic growth, we don’t see a major disruption in long term corporate earnings growth, which would impact our outlook for stock market returns. However, there is likely to be material economic impacts in the near term. Rising energy prices may negatively impact consumer spending habits and could impact the Federal Reserve’s outlook for inflation. If Russian forces proceed beyond the Russian recognized territories or NATO forces intercede, we are likely to see a more protracted event. As long-term investors, we will adjust to the current investing climate as needed and reposition portfolios accordingly.

On Market Timing

2021 was a rare year with U.S. stocks enjoying tremendous returns without much volatility. Since 1980, the S&P 500 has averaged a drawdown of approximately 14% each year. Over the long term, investors in stocks expect to earn higher returns in exchange for taking on greater risk like the uncertainty we are experiencing of late. The volatility created by this most recent geopolitical event may entice investors to make changes to their portfolio and move money out of risk assets until things improve. Doing so is a form market timing and can hold significant risk. The best reaction is to consult with a financial professional to decide if any action is necessary.

The Bottom Line

History has shown attractive long term investment opportunities occur during times of crisis. Maintaining a diversified portfolio and rebalancing to maintain an appropriate amount of risk relative to your long-term goals is our preferred strategy during tumultuous times.

COUNTRY Trust Bank wealth management team

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- G. Ryan Hypke, CFA, CFP® - Portfolio Manager

- Weston Genoweth - Investment Analyst

- Jamie Czesak - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

Definitions and Important Information

Figure 1: Chart used with permission from Goldman Sachs Asset Management.

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher-rated securities.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss.