Market and Economic Outlook - Released 9/30/23

Key Takeaways:

- With continued strong data points, the probability of a soft landing has been increasing but we are not out of the woods yet. We suggest slightly favoring bonds over stocks in multi-asset portfolios.

- Valuations are not overly concerning to us, but we are still monitoring what impacts higher rates may have on investment opportunities within stocks.

- As the Federal Reserve approaches the end of its tightening cycle, we feel a shift towards longer-duration bonds is warranted.

The expression, "A bird in the hand is worth two in the bush" has been used in various forms across many cultures for centuries. As we assess the investment opportunities today, this ancient axiom seems as relevant as ever.

Today, the proverbial bird in hand appears to be investment grade bonds, which are trading at the highest yields we have seen in years. Conversely, stocks do not look overly expensive, but lofty expectations for earnings next year give us pause in a slowing economy. You could say stocks may have some risks hiding in the bush. The return potential in stocks is higher over the long term, but the tradeoff there is greater volatility. We believe the hurdle for taking on stock market risk is higher today with bonds providing a compelling alternative. Therefore, we suggest slightly favoring bonds over stocks in multi-asset portfolios while encouraging our clients not to lose sight of the risk tolerance which makes sense for them.

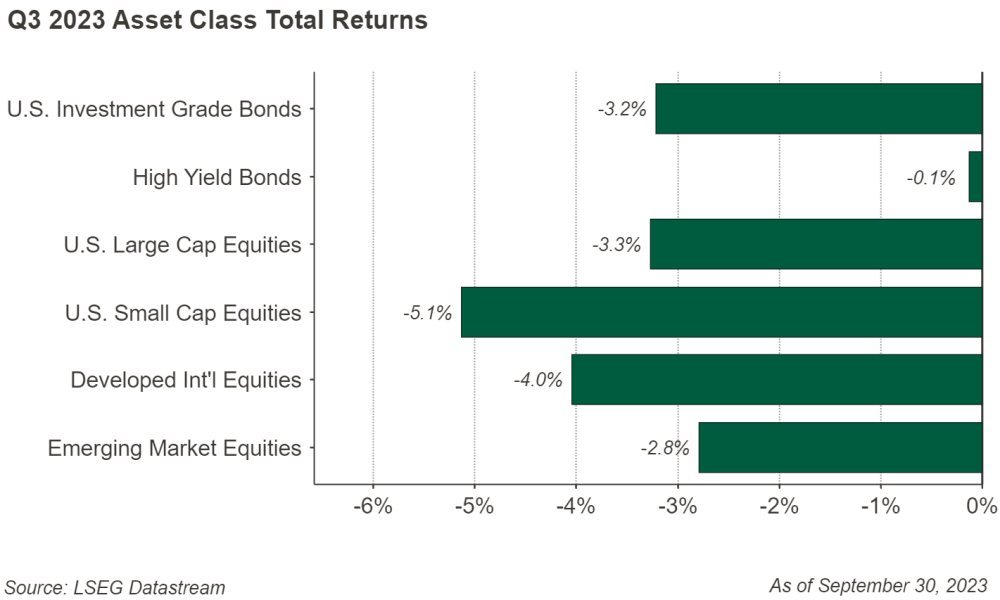

Market Pause

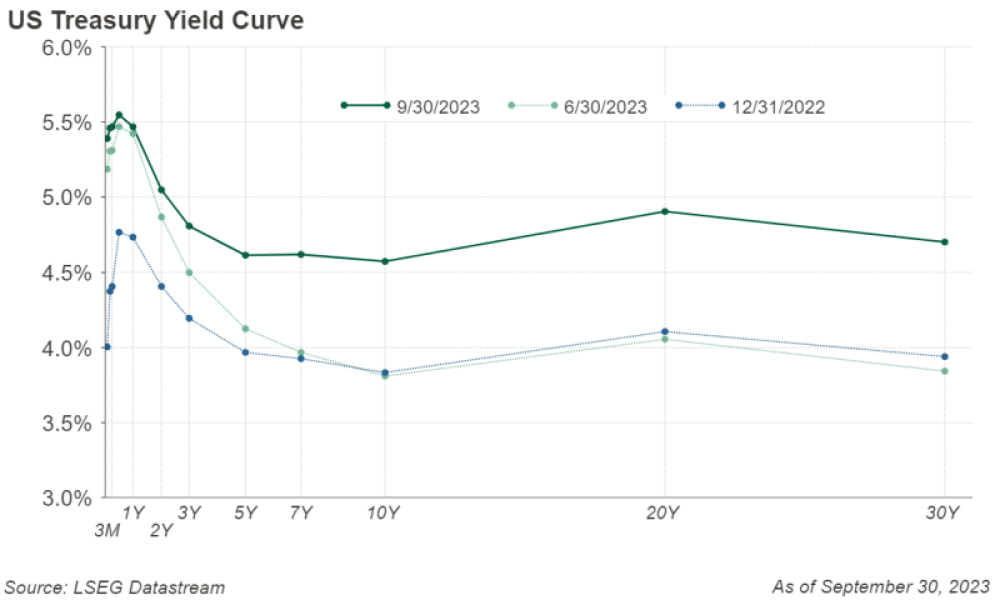

Markets took a pause in the third quarter after sharp upward moves in the first half of the year with the S&P 500 declining -3.3%, and small cap stocks returning -5.1%. International developed stocks were also down 4%, and emerging markets fell – 2.8%. Yields rose during the quarter with the 2-year treasury now comfortably above the 5% threshold closing the quarter at 5.05% and sending bonds down -3.2% (Figure 1).

Figure 1

Figure 1

Fed Hiking Finished?

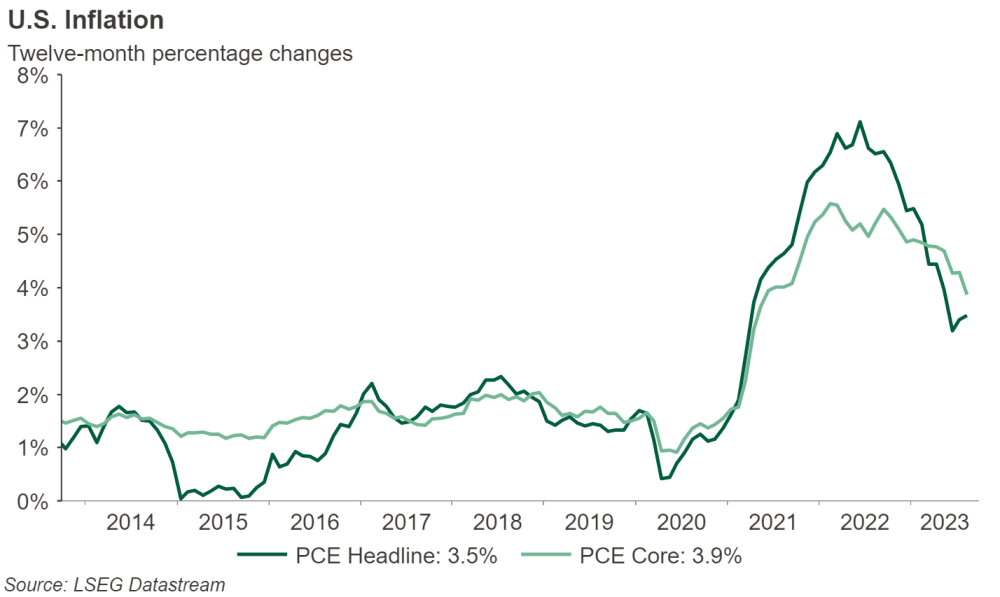

Headline inflation bounced back up in the quarter from 3.0% in June to 3.7% in August with food rising 4.3% over the past year and rents rising over 7%. Core inflation, which many feel is a better barometer for where future inflation is headed, continued its march down and now stands at 4.3% over the past year through August. PCE inflation, the preferred measure of the Fed, has ticked up as well and remains well above the 2% target (Figure 2). The Federal Open Market Committee (FOMC), after a pause in June, decided to raise the federal funds rate once more to a target range of 5.25% to 5.5%. The question now becomes “Will the Fed hike once more, as is in their projections, or was this the final rate hike of the cycle?”

Figure 2

Figure 2

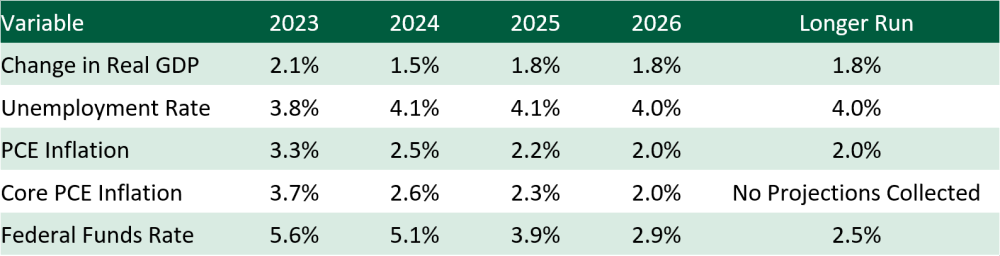

There are notable areas of strength that could either 1) allow the Fed to hike rates once more or 2) feed into the “higher for longer” interest rates narrative. Job openings have continued to come down from over 11 million to start the year to 8.8 million at the end of July. And while the JOLTS data has shown some loosening within the labor market, initial jobless claims continue to remain on the lower end. The Fed also came out with their economic projections (Figure 3). These show they expect the unemployment rate to rise just to 4.1% by the end of 2024 which is very close to their longer run projection of 4.0%. The 4-week average for initial claims has held within a range of 220-240 thousand since late July after peaking near 250,000 mid-year. The consumer also remains resilient amid rising prices. Retail sales in July rose 0.5% and rose another 0.6% in August rising more than expected.

Figure 3

Figure 3

Hard vs. Soft Landing

With these continued strong data points, the probability of a soft landing has been increasing, but we are not out of the woods yet. Much of the spending by consumers has been in the form of credit with credit card balances having risen over the $1 trillion mark for the first time according to the New York Federal Reserve (FRB). The cost to service these balances is going to increase from that of just a year ago and credit card delinquencies are beginning to rise primarily across those with lower incomes.

Beginning on October 1st, student loan payments will restart and could keep retail sales from continuing the upward momentum they have shown recently (the amount of student loans outstanding at the end of the second quarter was $1.77 trillion). Opinions on the extent of the resumptions impact vary and we will get more clarity through the end of the year and into 2024. Beyond this, we have also seen the price of energy increase with both Brent and WTI above $90 a barrel also having an impact on consumer spending. Brent rose 27.3% and WTI 28.5% in the quarter after dropping in the back half of 2022 and the first half of 2023.

Stocks at an Inflection Point

As we discussed last quarter, stock performance in the first half of the year was robust, driven mostly by strong performance in some of the top weighted names in the S&P 500. While the rally cooled some in August and September, valuations for the index still appear to be modestly elevated when evaluating them on a price-to-earnings multiple basis. On their own, valuations at this time are not overly concerning to us, but we are still monitoring what impacts higher rates may have on stock market valuations and the investment opportunities within stocks.

In our view, we have yet to see a significant impact of higher interest rates on corporate financing costs. Per research from Goldman Sachs, over $2 trillion of corporate debt matures in the next 3 years (GS). Even if rates fall below current levels, as companies go to refinance existing debt, they will likely need to do so at much higher interest rates. Many companies have recently passed on costs from inflationary pressures to sustain their margins. Because of this, they may be less able to pass on higher borrowing costs too. This dynamic could cause pressure on earnings growth as interest expenses rise, which could put pressure on price investors are willing to pay for companies with high debt burdens.

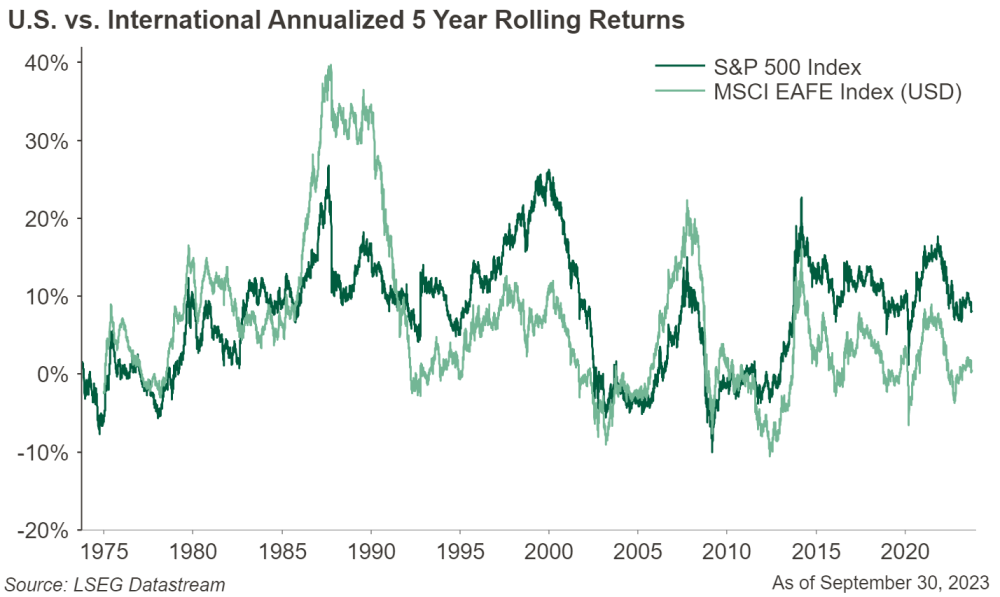

Neutral View on International

International stock valuations still look cheap compared to their U.S. peers, but it remains to be seen whether these stocks may experience sustained outperformance relative to the U.S. Although international stocks experienced some outperformance last year, U.S. stocks have still benefited from a strong decade of outperformance versus international developed market stocks (Figure 4). Despite attractive valuations, sector allocations, exchange rate considerations, and geopolitical risks continue to give us a neutral view on investment opportunities within international stocks.

Figure 4

Figure 4

Given this backdrop, we remain cautious on stocks overall, but we are still searching for selective opportunities down the market capitalization spectrum where valuations are more attractive. It is here where we are looking for value in strong businesses with good balance sheets that can navigate the economic uncertainties ahead.

Up Up and Away

Despite core measures of inflation trending lower and the Federal Reserve nearing the end of their hiking cycle, Treasury bond yields rose during the quarter (Figure 5).

Figure 5

Figure 5

Recent economic growth readings have made investors consider if the Fed is less likely to cut the federal funds rate significantly next year. Other factors for the increase include Fitch downgrading he United States from triple-A status, and expectations the U.S. Treasury needs to increase issuance to fund the budget deficit.

With bond yields hovering near multi-decade highs, our outlook is favorable. Historical data shows starting yields are a significant determinant of investment-grade bond returns, with approximately 95% of returns over 5-10 years being explained by initial yields for bonds held to maturity. The outlook is especially promising with potential for slowing inflation, which could lead to lower interest rates and increased total returns over the next few years. As the Federal Reserve approaches the end of its tightening cycle, we feel a shift towards longer-duration bonds is warranted and have begun positioning to have a longer duration than the broad intermediate term bond market. While the risk of rising interest rates is prevalent, higher coupon income can better offset short term losses.

Credit spreads, or the difference in the yield of two bonds with the same maturity remain tight. Currently, the market is showing little concern about a recession which could negatively impact the ability of corporations with weak balance sheets to meet their debt service obligations. Due to the low credit spreads, we continue to favor higher quality intermediate bonds as we do not believe we are being paid to take additional credit risk.

Bonds for the Long Haul

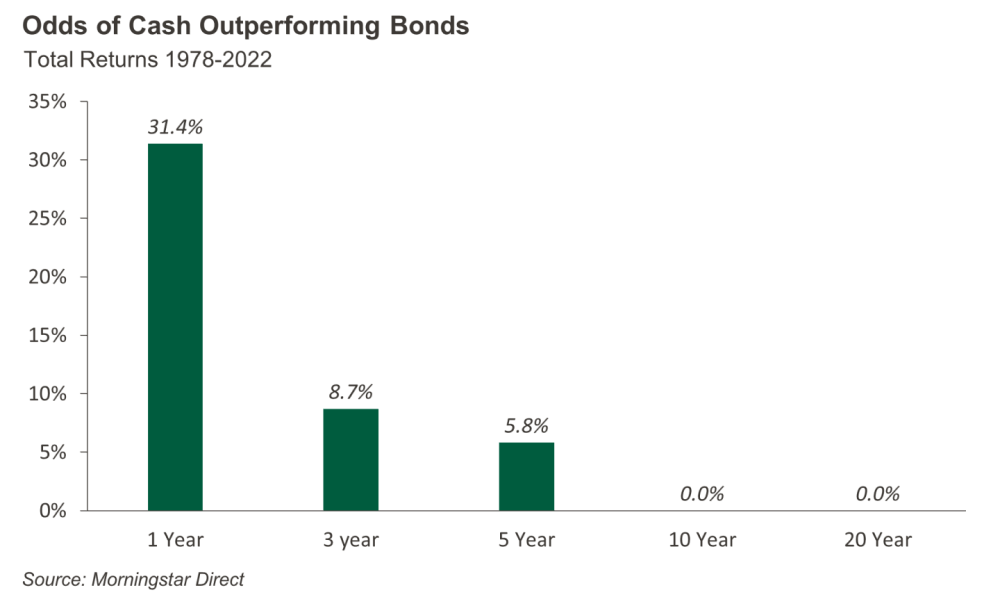

Unfortunately, most investors tend to look in the rear-view mirror to make investment decisions. After 2022, a year where the Bloomberg Aggregate Bond Index produced poor returns, many are seeking lower risk options within their fixed income portfolio. We believe it makes sense for an investor with a short-term goal to try to match the duration of their holdings to their liability. In certain cases, using cash equivalents or money market to reach this goal is prudent. However, for long-term investors they could be better off holding their intermediate term bonds.

We compared investment grade bond returns to returns on cash equivalents (Figure 6) by measuring rolling returns of the Bloomberg Aggregate Bond Index to cash using the FTSE Treasury Bill 3 Month Index as a proxy. In 31.4% of the rolling 1 year periods cash outperformed. However, over a longer period like 3 and 5 years it was rare for an investor to be better off investing in cash compared to intermediate term bonds. Over the 10- and 20-year periods bonds outperformed in every rolling period.

Figure 6

Figure 6

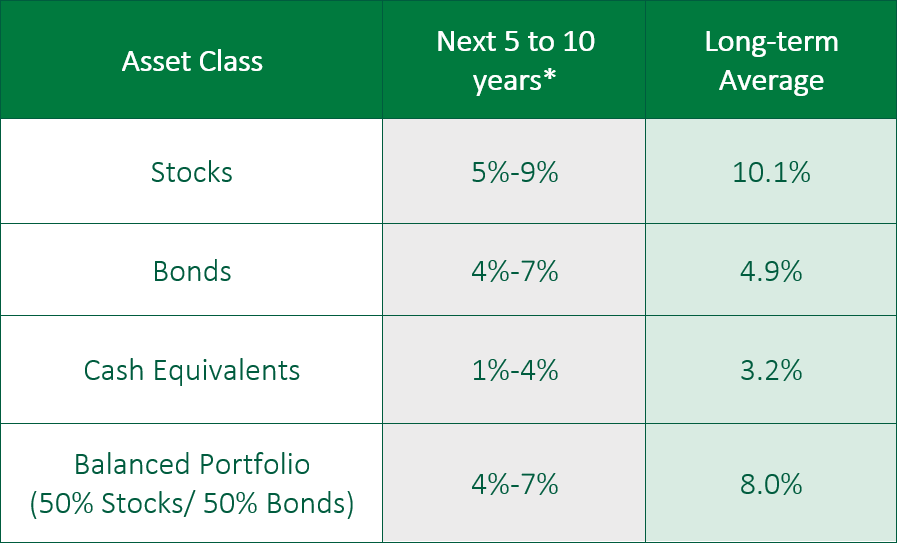

The Bottom Line

Investing with a long-term perspective usually takes precedence over short term thinking. Investment grade fixed income seems compelling while we remain concerned about the impact an uncertain economic future could have on stock prices in the near term. While our investment process looks to capitalize on short-term dislocations, we always advise clients not to lose grip of their long-term plan.

Figure 7

Figure 7

*Forecasted average annual returns of COUNTRY Trust Bank Wealth Management

Source: Morningstar and COUNTRY Trust Bank® - See Definitions and Important Information below

COUNTRY Trust Bank® Wealth Management Team

- Troy Frerichs, CFA - VP, Investment Services

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- G. Ryan Hypke, CFA, CFP® - Portfolio Manager

- Beau Lartz, ChFC® - Investment Analyst

- Cody Behrens, ChFC® - Investment Analyst

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Michelle Beckler - Investment Analyst

- Samantha Reichert - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

All information is as of the report date, unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Definitions and Important Information

Figures 1,2,4,5: Chart data comes from LSEG (formerly Refinitiv) DataStream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis.

Figure 3: Chart data comes from The Federal Open Market Committee (FOMC). They produce a Summary of Economic Projections of the most likely outcomes for real gross domestic product (GDP) growth, the unemployment rate, and inflation for each year from 2023 to 2026 and over the longer run. Each participant’s projections are based on information available at the time of the meeting, together with her or his assessment of appropriate monetary policy—including a path for the federal funds rate and its longer-run value—and assumptions about other factors likely to affect economic outcomes:

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20230920.htm

Figure 6: Chart data comes from proprietary analysis performed in Morningstar Direct.

Figure 7: The long-term average return data comes from Morningstar and is based upon compound average annual returns for the period from 1926 through December 31, 2022. Stocks are represented by the Ibbotson® Large Company Stock Index, which is comprised of the S&P 500® Composite Index from 1957 to present, and the S&P 90® Index from 1926 to 1956. Bonds are represented by the Ibbotson® U.S. Intermediate-Term Government Bond Index. Cash Equivalents are represented by the 30-day U.S. Treasury bill. The “Balanced Portfolio” is representative of an investment of 50% stocks and 50% bonds rebalanced annually. Forecasted stock returns include small capitalization and international equities. Forecasted bond returns include investment grade corporate bonds. These returns are for illustrative purposes and not indicative of actual portfolio performance. It is not possible to invest directly in an index.

GS: Walker, & Mori (2023, August 6). The Corporate Debt Maturity Wall: Implications for Capex and Employment. US Economics Analyst. Retrieved September 28, 2023, from: https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20230920.htmt

FRB: Haughwout & Others (2023, August 8). Credit Card Markets Head Back to Normal after Pandemic Pause. Liberty Street Economics. Retrieved September 26, 2023, from: https://libertystreeteconomics.newyorkfed.org/2023/08/credit-card-markets-head-back-to-normal-after-pandemic-pause/

The FTSE 3 Month US T Bill Index Series is intended to track the daily performance of 3-month US Treasury bills. The indexes are designed to operate as a reference rate for a series of funds.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity, and volatile prices.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher- rated securities.

The yield curve plots the interest rates of similar-quality bonds against their maturities. The most common yield curve plots the yields of U.S. Treasury securities for various maturities. An inverted yield curve occurs when short-term rates are higher than long-term rates.

The federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. The Federal Open Market Committee, which is the primary monetary policymaking body of the Federal Reserve, sets its desired target range.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas.

Credit spreads measure the difference in yields between bonds with the same maturity but different credit quality.

The price-to-earnings ratio is a valuation ratio which compares a company's current share price with its earnings per share (EPS). EPS is usually from the last four quarters (trailing P/E), but sometimes it can be derived from the estimates of earnings expected in the next four quarters (projected or forward P/E). The ratio is also sometimes known as "price multiple" or "earnings multiple."

PCE is an estimated total of personal consumption expenditures compiled by the U.S. government monthly as one way to measure and track changes in the prices of consumer goods over time. PCEs are household expenditures. PCEs as well as personal income statistics and the PCE Price Index are released monthly in the Bureau of Economic Analysis (BEA) Personal Income and Outlays report.

The JOLTS report tells us how many job openings there are each month, how many workers were hired, how many quit their job, how many were laid off, and how many experienced other separations.

Brent crude oil is a type of light sweet crude oil that is used as a global benchmark for global oil prices. WTI is the main oil benchmark for North America as it is sourced from the United States, primarily from the Texas Permian Basin.

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index that covers the USD-denominated, investment-grade, fixed rate, taxable bond market of securities. The Index includes bonds from the Treasury, Government-Related, Corporate, MBS, ABS, and CMBS sectors.