COUNTRY Trust Bank® Special Report - Update on Market Volatility

Key takaways

- Inflation concerns have led to sharp increases in longer-term interest rates, causing a volatile decline in stock and bond prices so far this year.

- However, we continue to be overweight stocks vs. bonds within multi-asset portfolios, as the downward move in global stock prices has made them more attractive. We believe return prospects are much better today than they were to start 2022.

- A market sell off is a good time to check your financial plan and assure you are on track to reach your investing goals for tomorrow.

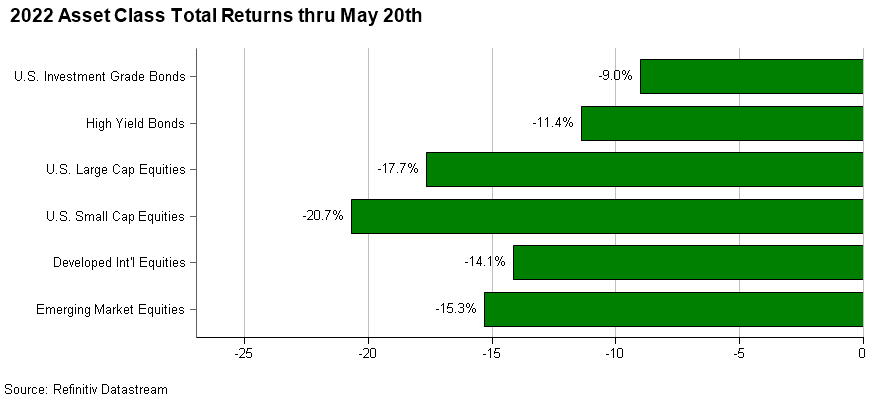

2022 Asset Class Total Returns thru May 20th

Global financial markets have had a rough start to 2022. In our most recent Market & Economic Outlook, we discussed the risks facing investors today. Chief among these risks is inflation. Inflation concerns have led to sharp increases in longer-term interest rates. The Federal Reserve has followed by communicating their intentions to steadily raise the federal funds rate to reduce the highest inflation data seen since the 1970s. Rising rates have caused investors to adjust their expectations for market returns going forward in a higher rate environment. This rerating has led to a volatile decline in stock and bond prices so far this year. However, we believe the price decreases in certain pockets of the U.S. stock market was needed given the strong price increases we have seen in the recent past.

Within stock markets, rising interest rates have most negatively impacted growth stocks. Growth stocks tend to have greater revenue and earnings in future years versus today. When interest rates rise, investors are less willing to pay higher prices for those earnings which occur well into the future causing prices to drop. On the bond side, rising interest rates also have a negative impact on bond prices. As interest rates rise, bond prices fall. Higher interest rates are, however, more appealing for fixed income investors.

Many clients are asking what changes we are making to portfolios in this environment. As long-term investors, we tend to avoid the noise that occurs during a market sell off. Not surprisingly, we have not made major adjustments to our asset allocation strategy. We continue to be overweight stocks vs. bonds within multi-asset portfolios. The downward move in global stock prices has made them more attractive. We believe return prospects are much better today than they were to start 2022 and have better conviction in our overweight to stocks. We remain cautious on international stocks due to geopolitical uncertainty. Within fixed income, higher interest rates now provide more income to offset price declines. We continue to maintain less sensitivity to interest rate movements than our benchmark and continue to position portfolios in nontraditional income categories like floating rate loans. We continue to believe high quality bonds provide diversification to stock market risk over the long term and should form the core of a bond portfolio. Alternative asset classes like infrastructure have also been a positive contributor year-to-date producing positive returns despite the broad stock market declines. We will continue to rebalance Journey Series portfolios when appropriate to maintain the asset allocation the client has chosen.

Whenever a drawdown in the stock market occurs, it is especially painful for retirees who are no longer making regular contributions to their accounts and are withdrawing funds. We believe for those investors this is a great opportunity to reassess your financial plan. Analyzing how the current market drop has impacted your plan can let you know if you are still on path to meet your goals. It is important to consider not only the current value of your assets but also your time horizon, goal for the funds and spending needs along with a variety of future inflation scenarios. We would not advise making changes to your portfolio based on market movements over a few months but would recommend changes if your long-term financial plan suggests a different investment strategy. A market sell off is a good time to check where you are at today and assure you are on track to reach your investing goals for tomorrow.

COUNTRY Trust Bank Wealth Management Team

- Troy Frerichs, CFA - VP, Investment Services

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- G. Ryan Hypke, CFA, CFP® - Portfolio Manager

- Weston Chenoweth - Investment Analyst

- Beau Lartz - Investment Analyst

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Jamie Czesak - Investment Analyst

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

Definitions and Important Information

2022 Asset Class Total Returns thru May 20th: Chart data comes from Refinitiv (formerly Thomson Reuters) DataStream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis. U.S. Investment Grade Bonds – iShares Core US Aggregate Bond ETF, U.S. Large Cap Equities – S&P 500® Index, U.S. Small Cap Equities – Russell 2000® Index, Developed International Equities – MSCI EAFE Index, Emerging Market Equities - MSCI Emerging Markets Index.

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it is considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

The MSCI EAFE Index is a benchmark for U.S. investors to measure international equity performance. It comprises the MSCI country indexes capturing large and mid-cap equities across developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada.

The iShares Core U.S. Aggregate Bond ETF seeks to track the investment results of the Bloomberg Barclays US Aggregate Bond Index. The Bloomberg Barclays US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 emerging market countries. The index free float-adjusted market capitalization index and represents 13% of global market capitalization.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity and volatile prices.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher-rated securities.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss.