Market and Economic Outlook - Released 3/31/23

Key Takeaways:

- Given there is a significant amount of uncertainty moving forward, we believe it makes sense in the current environment to position multi asset portfolios neutrally between stocks and bonds.

- We currently view this as an opportunity to adjust portfolio exposure, seeking value in quality stocks over more speculative stocks.

- Income investors are no longer forced to take substantial credit risk to earn a meaningful return. Given the higher likelihood of a recession, we believe it makes sense to have a bias towards high quality investment grade bonds.

Baseball great Ted Williams once said the most important thing in hitting a baseball is waiting for the right pitch. Williams, in his book, The Science of Hitting, dissected his batting average based on specific baseball sized sections covering the strike zone. He determined the greatest outcome for success was to hit pitches near the middle of the plate. If he waited for these pitches, he would have optimal results.

While not as skilled at baseball as Ted Williams, we do believe some of these lessons can be applied to the world of investing. We have never believed in market timing but patiently stand ready to take advantage of opportunities we deem attractive relative to our assessment of the risks. Today, we attempt to navigate the risks of possible persistent inflation, the lagged effects of the Fed raising interest rates on the economy, and the challenges we have seen in the banking sector.

Dissecting the Start of 2023

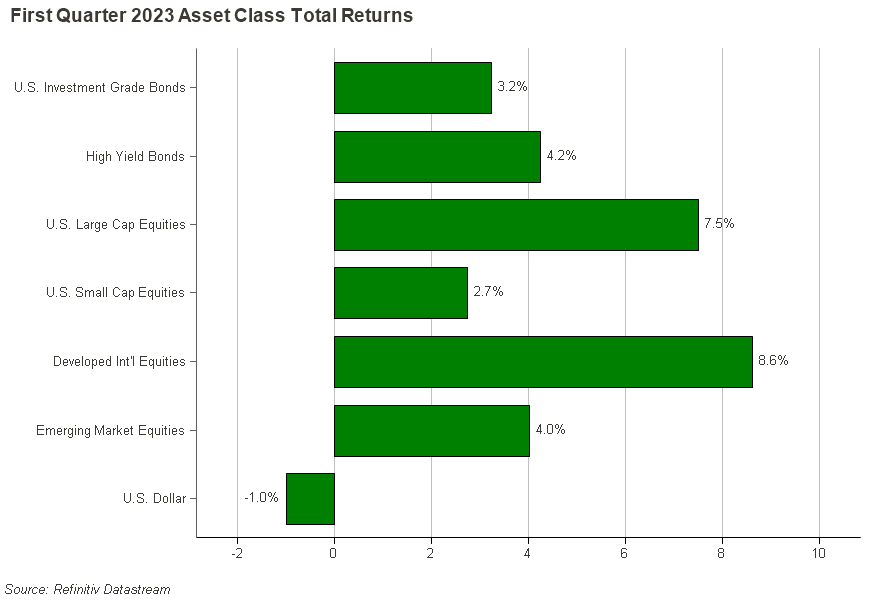

The first quarter has shown solid returns in most areas of the market with the S&P 500 index up 7.5%, international developed stocks up 8.6% and investment grade bonds up 3.2% (Figure 1). Equity markets quickly climbed in January, but lost steam soon after due to expectations for interest rate increases to continue their climb and remain higher for longer. The start of March quickly brought expectations for additional rate hikes back down, however, the failure of two regional banks brought to light the lagging effects of a swift tightening in monetary policy. While markets have calmed down in recent weeks, we should expect continued volatility as we move through the year.

The macroeconomic environment remains a mixed bag and there is still much uncertainty moving forward. The Fed is committed to bringing inflation down towards its target but is seemingly caught between a rock and a hard place. They have the difficult job of trying to tame inflation, while at the same time engineering a soft landing that doesn’t throw the U.S. into a recession.

Figure 1

Figure 1

Puts and Takes

On the positive side, the labor market remains historically strong with an unemployment rate of 3.6%, initial jobless claims are still under 200K, and non-farm payrolls have gained by 815,000 in the first two months of the year. The number of job openings remains plentiful as well with the most recent JOLTS report showing 10.8 million jobs still available. Retail sales sped up in January and at the end of February remained 5% higher than a year ago.

On the more challenging side of the equation, the most recent headline inflation reading, while having come down considerably from its highs, remains at 6% which is well above the Fed’s 2% target. We have also seen the failure of two banks, Silicon Valley Bank and Signature Bank, with recent rate increases a key ingredient in their failures. The Fed will need to navigate the desire to bring down inflation and the impact additional rate increases will have on the economy. Tough choices will lie ahead as the path toward a soft landing continues to be difficult.

While it remains to be seen if we will get a recession in the near future, the consumer remains resilient, and GDP growth is expected to be steady to start the year with the Atlanta Fed’s GDPNow model predicting a 2.5% increase for the first quarter. In this model, consumer spending is expected to add about 3.1% to the equation with private inventories detracting.

Despite an erratic quarter for U.S. stocks, valuations don’t appear like a pitch down the middle to us yet. Investors are unlikely to hit a home run in bonds, however we feel the risk reward in fixed income looks more attractive. Given there is a significant amount of uncertainty moving forward, we believe it makes sense in the current environment to position multi asset portfolios neutrally between stocks and bonds.

Lagging Sectors Shine

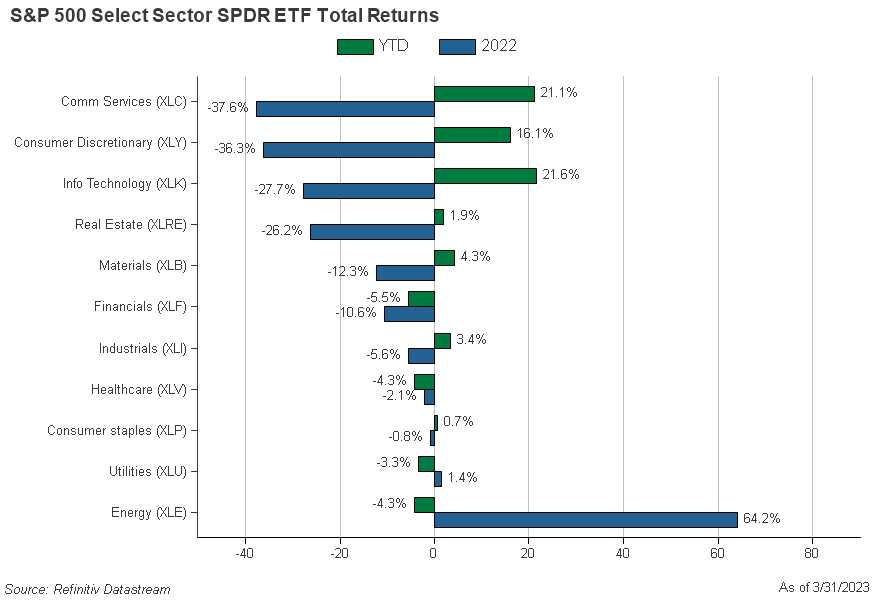

In almost a mirror image of 2022, in the first quarter of this year, we saw a strong rally in many sectors of the S&P 500 that underperformed by the largest margin last year (Figure 2). This includes the Communication Services, Consumer Discretionary, and Information Technology sectors. Investors who reduced exposures to these sectors in favor of stronger performing sectors like Energy and Utilities last year, for example, would have experienced additional underperformance from this trading strategy to start 2023.

Figure 2

Figure 2

We believe this demonstrates the importance of portfolio diversification and avoiding market timing even within stock exposures as market dynamics can change very quickly for any number of reasons. As a result, we feel it makes sense to maintain varying magnitude of exposure across the universe of economic sectors in most environments. This is also why, despite the banking crisis and bank stocks coming under pressure, major indexes were still able to finish higher for the quarter.

We saw the rally in the above-mentioned sectors of the market as their share prices grew strongly, even as we continued to see earnings estimates for the S&P 500 decline. This puts pressure on valuations as their price to earnings ratio grows larger in this environment (higher share price, lower expected earnings). While stocks do not look egregiously expensive here, as we mentioned last quarter, we are still expecting an earnings recession in 2023 and see this rally as stretching valuations further. We expect additional pressure on bank earnings estimates as we start to dissect the magnitude of lost deposits due to the banking failures we saw in March, which may create further downside bias in earnings estimates for major US stock market benchmarks.

Quality and Profitability over Speculative

Considering this backdrop, we remain patient and continue to look for our pitches to hit. Given the modest rally we have seen in broad stock market benchmarks to start the year, we currently view this as an opportunity to adjust portfolio exposure, seeking value in quality stocks over more speculative stocks.

The clearest example for lower quality/speculative stocks to us is within a segment of U.S. small cap stocks. The number of unprofitable companies in the Russell 2000 benchmark of small cap stocks has grown steadily over recent years and now stands at around 42% (JPM). These smaller and unprofitable stocks could face greater pressure in a higher rate environment, and if we face an economic recession, their ability to raise capital to fund continued operations becomes more and more difficult.

As a result of this outlook, we have taken the opportunity to reduce our exposure to smaller cap stocks broadly in favor of their larger cap peers and remain focused on owning companies in both segments with a bias towards quality and profitability. We continue to have a neutral view on international stocks, despite strong performance to start the year, for the same potential risks we have discussed in recent quarters, and the risk of commodity price exposure in emerging market stocks.

Favorable Bond Yields Remain

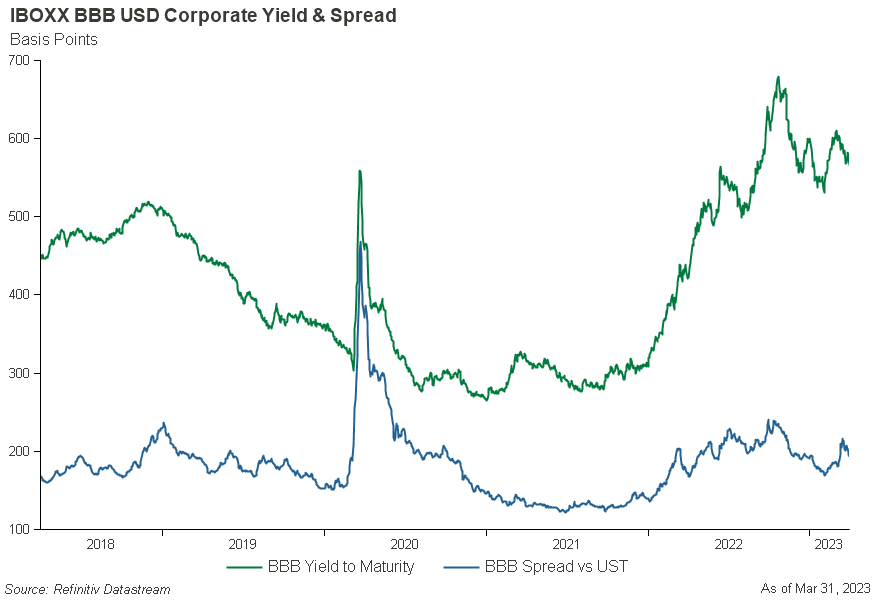

Despite a steeply inverted yield curve, the investment opportunity in bonds remains attractive to us compared to riskier assets. One reason for this is the level of interest rates. The Fed has increased the Fed Funds rate by 4.75% in just over a 1-year period which has also caused longer-term interest rates to rise since March of 2022. Volatility related to the regional bank crisis in mid-March prompted investors to seek safe assets. This caused interest rates to decline from their recent highs but credit spreads, or the difference in the yield of two bonds with the same maturity but different credit quality, increased (Figure 3).

Figure 3

Figure 3

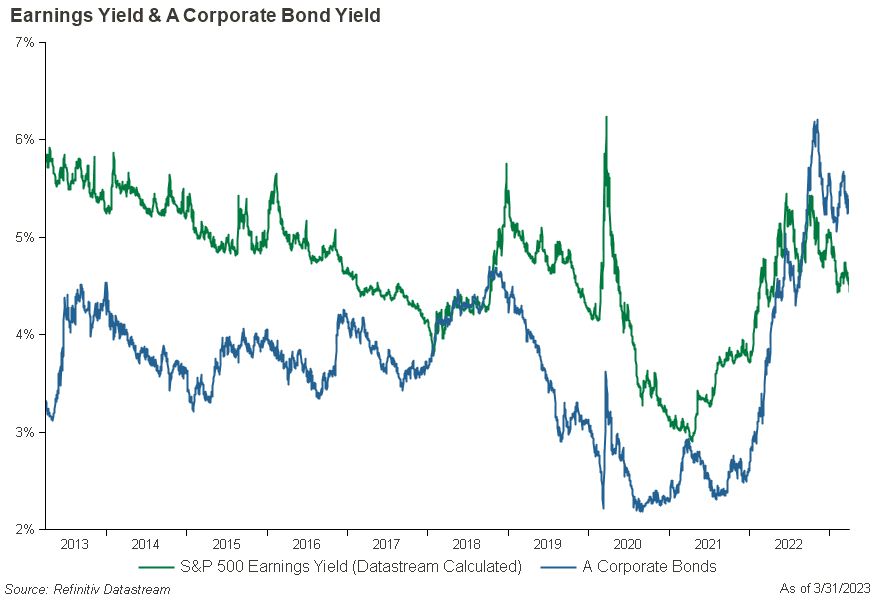

Earnings yield is the reciprocal of the P/E ratio and states how much a stock investor earns per share. It is often used to compare the relative attractiveness of bonds vs. stocks. Today, the yield of investment grade corporate bonds is higher than the earnings yield of the S&P 500 (Figure 4).

Figure 4

Figure 4

Income investors are no longer forced to take substantial credit risk to earn a meaningful return. Given the higher likelihood of a recession, we believe it makes sense to have a bias towards high quality investment grade bonds.

Don’t Abandon Duration

It was a successful strategy during 2022 to invest exclusively in short term fixed income securities. However, investors are incorrect in thinking they should only be allocating to Treasury Bills or cash equivalents instead of intermediate and long-term bonds. Cash has become a viable alternative for short term goals. However, it would be foolish to dismiss intermediate term bonds for longer term goals.

High quality intermediate term fixed income instruments allow today’s yields to be captured for longer. Yields on cash equivalent securities like Treasury Bills could be temporary, as they will be more susceptible to the Fed changing course and lowering rates. Duration, a measure of interest rate sensitivity of longer maturity bonds, may provide stability against volatility in a portfolio if we eventually enter a recession and rates fall. Based on quarter end yield to maturity and duration measures, a 1% fall in rates could lead to total returns of +10% or more for the Bloomberg Aggregate Bond Index. Higher yields can also provide a cushion to bond prices, relative to lower yields, if rates increase from here.

The Bottom Line

Investing is difficult because the outlook always appears uncertain. As any great hitter or investor knows patience is critical to long term success. There are times when the best plan, for even the greatest hitters, is to not swing for the fences, but to find a level of risk which makes sense for your goals and remain disciplined. We believe financial markets will remain challenged over the course of the year but are comforted by better yields provided by high quality income producing investments. Amidst uncertainty, a trusted advisor can help keep you in the game.

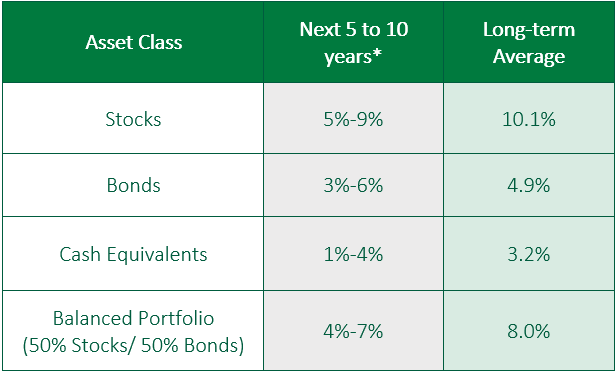

Figure 5

Figure 5

*Forecasted average annual returns of COUNTRY Trust Bank Wealth Management

Source: Morningstar and COUNTRY Trust Bank® - See Definitions and Important Information below

COUNTRY Trust Bank® Wealth Management Team

- Troy Frerichs, CFA - VP, Investment Services

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- G. Ryan Hypke, CFA, CFP® - Portfolio Manager

- Weston Chenoweth - Investment Analyst

- Beau Lartz, ChFC® - Investment Analyst

- Cody Behrens, ChFC® - Investment Analyst

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Michelle Beckler - Investment Analyst

- Samantha Reichert - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

All information is as of the report date, unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Definitions and Important Information

Figures 1,2,3,4: Chart data comes from Refinitiv (formerly Thomson Reuters) DataStream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis.

Figure 2: Demonstrates the total returns, as calculated by Refinitiv DataStream, of the S&P 500 SPDR Select Sector ETFs as proxy for broad economic sector total returns.

Figure 5: The long-term average return data comes from Morningstar and is based upon compound average annual returns for the period from 1926 through December 31, 2022 Stocks are represented by the Ibbotson® Large Company Stock Index, which is comprised of the S&P 500® Composite Index from 1957 to present, and the S&P 90® Index from 1926 to 1956. Bonds are represented by the Ibbotson® U.S. Intermediate-Term Government Bond Index. Cash Equivalents are represented by the 30-day U.S. Treasury bill. The “Balanced Portfolio” is representative of an investment of 50% stocks and 50% bonds rebalanced annually. Forecasted stock returns include small capitalization and international equities. Forecasted bond returns include investment grade corporate bonds. These returns are for illustrative purposes and not indicative of actual portfolio performance. It is not possible to invest directly in an index.

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index that covers the USD-denominated, investment-grade, fixed rate, taxable bond market of securities. The Index includes bonds from the Treasury, Government-Related, Corporate, MBS, ABS, and CMBS sectors.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity, and volatile prices.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher- rated securities.

The yield curve plots the interest rates of similar-quality bonds against their maturities. The most common yield curve plots the yields of U.S. Treasury securities for various maturities. An inverted yield curve occurs when short-term rates are higher than long-term rates.

The federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. The Federal Open Market Committee, which is the primary monetary policymaking body of the Federal Reserve, sets its desired target range.

The price-to-earnings ratio is a valuation ratio which compares a company's current share price with its earnings per share (EPS). EPS is usually from the last four quarters (trailing P/E), but sometimes it can be derived from the estimates of earnings expected in the next four quarters (projected or forward P/E). The ratio is also sometimes known as "price multiple" or "earnings multiple."

The JOLTS report tells us how many job openings there are each month, how many workers were hired, how many quit their job, how many were laid off, and how many experienced other separations.

GDPNow is not an official forecast of GDP from the Atlanta Fed. It is best used as viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no

subjective adjustments made to GDPNow the estimate is based solely on the mathematical results of the model. Data as of March 31, 2023

Earnings yield is the inverse of the price-to-earnings ratio, measuring earnings per share as a percentage of a stock’s price.

Credit spreads measure the difference in yields between bonds with the same maturity but different credit quality.

The yield to maturity (YTM) is the total rate of return that will be earned by a bond when it makes all interest payments and repays the original bond if held to maturity.

JPM: J.P. Morgan Asset Management. (2022, December 31). Guide to the Markets 12.31.2022 – Slide 11:” Small Cap vs. Large Cap Stocks”. Retrieved March 29, 2023, from J.P. Morgan Asset Management