Let's talk about life insurance for you and your family.

Let's talk about life insurance for you and your family.

Get the basics

Life insurance does more than give you peace of mind. It’s an important leg of your unique financial journey.

Why do you need it?

If something should happen to you, life insurance can help your family to:

- Replace your income

- Handle final expenses

- Pay off outstanding debt

- Contribute to future education costs

How do I know if I need term or permanent life insurance?

It depends on your situation. An easy way to think about the difference is to compare them to the idea of renting or owning a home. Term life insurance would be "renting" and permanent life insurance would be "owning."

Not sure which option is right for you?

Term Life

Term life insurance generally costs less per month and only covers you for a set time period.

Permanent Life

Permanent life insurance provides lifetime coverage, with more available features, at a higher cost.

Explore Whole or Universal Life

Life Insurance Calculator

Estimate your coverageYour Result

You're in good shape!

Based on your answers, it sounds like you've already taken important steps to make sure you're covered.

As your life changes, your insurance needs might change, too. Schedule a complimentary review below to make sure you're properly protected.

This information is for illustrative purposes only and is not intended to be a recommendation for any specific product or amount of coverage. It does not take into consideration all factors that may affect your specific need, including social security benefits and the time value of money.Here's how much life insurance you may need:

Based on your answers, you're well on your way to making sure you're covered.

As your life changes, your insurance needs might change, too. Request a complimentary review below to make sure you're properly protected.

This information is for illustrative purposes only and is not intended to be a recommendation for any specific product or amount of coverage. It does not take into consideration all factors that may affect your specific need, including social security benefits and the time value of money.Here's how much life insurance you may need:

Based on your answers, it sounds like you may benefit from a complimentary review to make sure you're properly protected

Fill out the form below to request an appointment.

This information is for illustrative purposes only and is not intended to be a recommendation for any specific product or amount of coverage. It does not take into consideration all factors that may affect your specific need, including social security benefits and the time value of money.Request a review

How much coverage do I need?

The amount of life insurance you need depends on several things, like the number of children you have, your mortgage, income and more.

What factors impact the cost of life insurance?

Several things affect your life insurance costs, but these are some of the most common. Your:

- Age

- Occupation

- Health

- Family medical history

- Lifestyle

Remember: Life insurance is never as affordable as it is today.

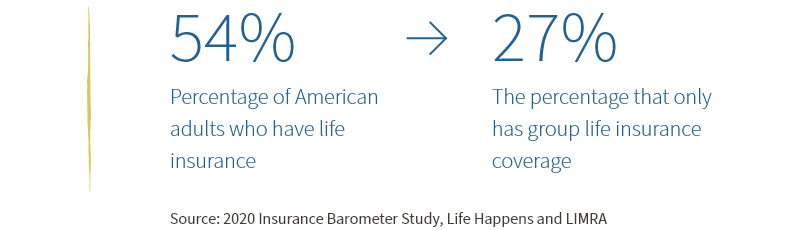

40% is the percentage of those who wished they purchased life insurance when they were younger.

Source: 2020 Insurance Barometer Study, Life Happens and LIMRA

You might also be interested in

Life (Insurance) Can Be Full of Surprises

There's a lot to consider when it comes to life insurance.

Term vs Whole Life Insurance

Ways to think about term vs whole life insurance coverage is comparing them to the idea of renting or owning a home

Are Your Beneficiaries up to Date?

Keep your beneficiaries up to date so your assets go to the people you want.

Life insurance policies issued by COUNTRY Life Insurance Company® and COUNTRY Investors Life Assurance Company®, Bloomington, IL.

The information and descriptions contained here are not intended to be complete descriptions of all terms, conditions and exclusions applicable to the products and services. The precise insurance coverage under any COUNTRY Life Insurance Company® and COUNTRY Investors Life Assurance product is subject to the terms, conditions and exclusions in the actual policies as issued. Products and services described in this website vary from state to state and not all products, coverages or services are available in all states.

1Policy loans and withdrawals decrease the cash value and death benefit amount of the policy. The decision to purchase life insurance should be primarily based on a need for the death benefit. Policies are not an investment and are not appropriate as a replacement for retirement savings accumulation.

Term Life Insurance: Spouse Rider ICC17(TLIS)

Term Life Insurance: Insured Rider ICC17(TLII)

Child Term Rider ICC18(CTR)

Paid-Up Life Insurance Rider ICC18(PUAR)

Guaranteed Insurance Option Rider ICC18(GIO)

Accidental Death Option ICC18(ADB)

Indexed Dividend Feature Rider ICC19(IDR)

Disability Waiver of Premium Benefit ICC18(DWP565)

Whole Life Policy ICC18(WL)

Single Premium WL form no. ICC18(WLSP)

Payor Death or Disability Waiver of Premium Rider ICC18(PDD)