COUNTRY Trust Bank® Special Report - Planning Post-Election 2020

Key takeaways

- Narrow legislative advantages may make it difficult to pass significant changes affecting tax legislation.

- Campaign promises included higher federal income tax rates and capital gains rates. Lower estate tax exemptions and a loss in the step-up-in-basis at death could result in more estates subject to tax.

- Support is growing for some relief from student loan debt.

- Improvements may be on the horizon impacting how Americans save for retirement and to bolster the Social Security System.

- With uncertainty looming, it’s time to focus on things we can control that may affect the success of our planning efforts.

On January 20th, 2021, Joseph Biden became the 46th president of the United States. Following a tumultuous campaign and period following the popular election, our Wealth Management teams began analyzing much of the proposed legislation as well as campaign promises. The effect of these proposed changes could have a significant impact as to how people save and invest their monies as well as impacts to income taxes and legacy goals.

Slim Majority Means Tough Going for Most Legislation

A Democratic White House, House of Representatives, and Senate mean that some of President Biden’s top legislative priorities may face less opposition between now and the next midterm elections in 2022. However, the 50-50 split in the Senate, with Vice President Kamala Harris breaking ties, implies that new legislation may require bipartisan support. The most ambitious and progressive reforms may be difficult, if not impossible, to pass, especially as the U.S. economy continues to be impacted by the COVID pandemic.

Income and Estate Taxes Could Rise

Proposals from then candidate Biden centered on increasing income taxes, changes to the taxation of capital gains, and a return to a lowered estate tax exemption.

President Biden campaigned on a platform of increasing income taxes on those making more than $400,000. His proposal would increase the individual income tax rate for taxable incomes above $400,000 from 37% to 39.6% - the rate in effect prior to the Tax Cuts and Jobs Act of 2017.

In addition, a proposal could include taxes on long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6% for incomes above $1 million. Perhaps most impactful to the area of legacy planning is an elimination of step-up in basis for inherited assets, which would retain their pre-death basis and would be subject to capital gains taxation when sold.

Lastly, the administration has proposed restoring the unified gift and estate tax rates and exemptions to 2009 levels. As a result, the estate tax exemption would decrease from the current $11.7 million for individuals ($23.4 million for couples) to $3.5 million for individuals ($7 million for couples). The top estate tax rate would increase from 45% to 55%. Several states have already enacted estate tax or inheritance taxes at thresholds significantly below the current federal limits, and decedents could be subject to not only federal estate taxes, but taxes on a state level, as well.

Student Debt Looms

The amount of student debt now outpaces both auto loans and credit card balances1. According to the U.S. Department of Education, 43 million Americans owe a combined $1.6 trillion of student loan debt. As momentum grows to forgive some loans, the result may be an increased burden on American taxpayers. The Department also states that regardless of forgiveness, 1/3rd of the debt will not be repaid due to current provisions in the law, such as deferment or forbearance.

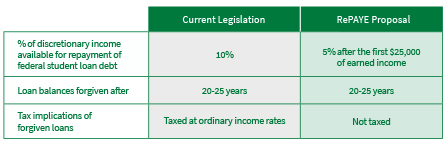

A tenant of President Biden’s campaign was a nod towards at least a $10,000 forgiveness of federal student loan debt along with an income-based repayment program. The notion of an income-based repayment program was first introduced under President Clinton in the 1990s. Biden’s proposal is RePAYE – revised pay as you earn.

Retirement Planning Impacts

The House Committee on Ways and Means Committee is the chief tax-writing committee of the U.S. House of Representatives. A broad number of proposals are on the table from both this committee and President Biden. Presidential proposals include increasing the age for Required Minimum Distributions from age 72 to age 75 and waive required distributions altogether if cumulative retirement account balances are $100,000 or less.

The House currently has a proposal titled The Securing a Strong Retirement Act. Key features include

- Expanded automatic enrollment in retirement plans

- Credits for small employer startup plans

- Increases to the Saver’s Credit

- Allowances for employers to use 401(k) matching contributions to help employees repay student-loan debt

- Expansion of limits on Qualified Longevity Annuity Contracts (QLACs)

Shoring Up Social Security

For many Americans, Social Security survivor and disability payments constitute a critical safety net. Retirement benefits from Social Security provide an important part of retirement income streams that may also include pension benefits and withdrawals from retirement accounts. Much of the benefit provided by these government benefits are a result of payroll taxes paid by employees and employers to the Old-Age, Survivors, and Disability (OASDI) trust fund. Significant changes to benefits and payroll taxes may be on the horizon.

Based upon the 2020 OASDI Trustees Report, under intermediate assumptions, Social Security Trust Fund assets for the payment of retirement benefits will become depleted in 2034. Even with the depletion of reserves, income to Social Security in the form of payroll taxes is projected to be sufficient to pay 76% of scheduled benefits.

On the campaign trail, Biden proposed changes to Social Security whereby eligible workers would receive a guaranteed benefit equal to at least 125% of the federal poverty level. Recipients who have received benefits for at least 20 years could see their monthly checks increase 5%, with widows and widowers receiving 20% more each month. There is also a proposal to change the measurement for the annual cost-of-living increases to the Consumer Price Index for the Elderly – CPI-E – which more closely tracks expenses of retirees.

To increase revenues, the Biden administration is likely to propose a 12.4% Old-Age, Survivors and Disability (Social Security) payroll tax on income earned over $400,000. This amount would be split evenly between employers and employees. The resulting tax would create a “donut hole” in the current payroll tax, such that wages between $142,800 (the current wage cap) and $400,000 would not be subject to Social Security payroll taxes.

Compromise is Key

A number of proposals exist for retirement and Social Security legislation, including options from both sides of the aisle. Representative John Larson of Connecticut has proposed to increase the solvency of Social Security for the next 75 years by increasing payroll taxes. Senator Bernie Sanders of Vermont has proposed changes to increase Social Security benefits for low earns while raising taxes for those with higher wages. Lastly, Senator Mitt Romney of Utah has promoted the TRUST Act, encouraging the formation of bipartisan committees to address social programs that face shortfalls and to fast track changes to improve them. With the myriad of proposals on the table, and tight margins along party lines, many expect that compromise will be necessary to address critical issues.

Control what you Can

In our view, it is better to avoid speculation and major changes to a financial plan based on proposed legislation and campaign promises. Our team continues to believe the best approach is to “control what you can” and focus on individual investing goals, instead of market headlines and which party holds the White House or Congress. Focusing on how much you a person saves and how much a person spends may have a greater impact on the overall success of a financial plan. A trusted financial professional can help establish a plan to withstand these changing times.

COUNTRY Trust Bank wealth management team

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Joe Buhrmann, CFP® - Manager, Financial Planning Support

- Bryan Daniels, CFP® - Financial Planner

- Scott Jensen, CFP® - Financial Planner

- Jason McPeak, CFP® - Financial Planner

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

Definitions and Important Information

Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. This index is referred to as CPI-U. In addition, an index is available for the elderly, CPI-E, using households whose reference person or spouse is 62 years of age or older.

Indexes are available for the U.S. and various geographic areas.

OASDI is the Old Age, Survivors, and Disability Insurance tax that is utilized to fund benefits under various Social Security programs.

1 Report on the Economic Well-Being of U.S. Households in 2018 - May 2019, Board of Governors of the Federal Reserve.