COUNTRY Trust Bank® Financial Planning Insights - Power of Permanent Life Insurance

“Fun is like life insurance; the older you get, the more it costs.” Kin Hubbard

In a world filled with constant change, we shouldn’t be surprised that things offering stability and consistency are appealing. Despite differing opinions, many people continue to value owning permanent life insurance policies. The predictability and security of permanent life insurance can be reassuring to people concerned about the ever-changing landscape of experiences and products in our modern lives.

Permanent life insurance policies provide long-term death benefit protection, predictable premiums (whole life policies) or flexible premiums (indexed universal life policies), policy cash values, and potential creditor protections.

- Death Benefit Protection - The ability to have death benefit protection that you can’t outlive. Many permanent policies may allow for that death benefit to grow over time, depending on how the policy is configured.

- Predictable or Flexible Premiums - The ability to have a predictable premium experience for whole life policies that can be “locked in” if desired. Some policies may allow you to have limited premium payment periods while supporting long-term protection. Indexed universal life policies allow for flexible premiums.

- Favorable Cash Value Access - The ability to have policy cash values growing under fax-favored conditions. When structured properly, cash values grow without annual taxation and allow the tax-free access of those accumulated values in future years.

- Creditor Protections - The ability to have limited creditor protection of life insurance cash values and death benefits. The amounts protected will vary by state and depend on circumstances, such as whether or not a bankruptcy filing is in effect.

Benefit protection you can’t outlive

The primary purpose of life insurance is to provide crucial funds to beneficiaries after an insured individual passes away. Our inevitable deaths make permanent life insurance an effective way to address the financial consequences of this unavoidable experience. Many permanent life insurance policies, such as whole life, don’t simply expire with the passing of time. Instead, they give consumers confidence that the policy death benefit will be available as long as sufficient premiums are paid. Payout isn’t contingent on death occurring within a limited time frame, as is the case with term insurance.

Term life insurance may be ideal for temporary protection needs. However, when the need exists regardless of how long one might live, a permanent life insurance policy may be the way to go. There are several types of policies which fall into the permanent category. Your COUNTRY Financial representative can explain which type may make the most sense for your long-term protection needs.

Predictable premium commitments

Most permanent life insurance, including whole life policies, offers consistent premiums that policyowners can budget for. Individuals with these policies benefit from predictable premiums while securing valuable death benefit protection. Some whole life policies even allow policyholders to fully pay up the policy within a specified timeframe. This can be helpful during retirement, when income may be limited but the need for permanent protection continues.

Indexed universal life insurance, a type of permanent life insurance, provides policyowners with significant flexibility in premiums and coverages. This flexibility can be valuable for individuals with less predictable incomes or who want to adjust their premium payments form year to year. This flexibility can be both a strength and weakness. Failure to pay adequate premiums into a universal life policy can jeopardize the potential for permanent death benefit protection.

Your COUNTRY Financial representative will be able to help you understand which type may make the most sense for your permanent protection needs.

Favorable cash value access

One key difference between most term policies and permanent life insurance policies is the presence of policy cash values. These cash values can be accessed by the policy owner for various “living benefit” needs. This may include policy loans, withdrawals, or partial surrenders.* When structured correctly, policyowners can use cash values without tax consequences, making them an attractive choice for many individuals.

When properly implemented, the cash value growth within a permanent life insurance policy offers benefits similar to those of a Roth IRA. Premiums are paid using after-tax dollars (like a Roth IRA). The cash value accumulates without current tax recognition (similar to a Roth IRA). For individuals unable to make Roth IRA contributions due to income-based phaseouts, a well-structured permanent life policy may offer a way to diversify the tax status of their investments while providing valuable death benefit protection.

The rules for ensuring a policy maintains tax-free cash value access are complex. Your COUNTRY Financial representative can guide you through these rules as needed. When dealing with potential tax consequences, we recommend seeking advice from your own tax professional. Keep in mind that accessing a policy’s cash value impacts the net death benefit, and could jeopardize the policy, which may lead to adverse tax consequences. Prudent and well-informed decisions about the consequences of different choices will help you manage these risks and increase your satisfaction.

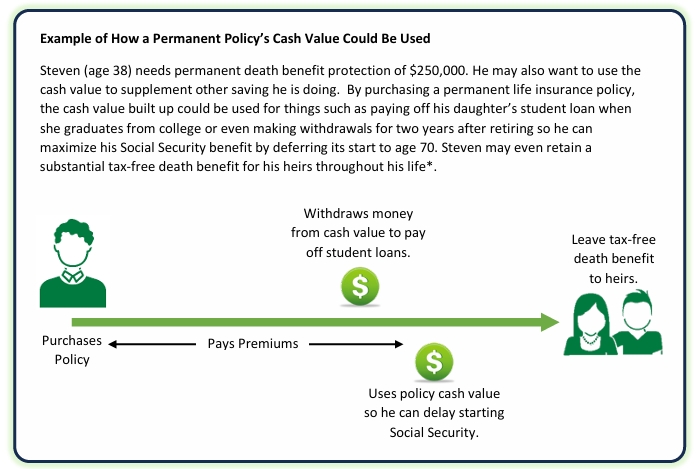

Consider some of the many ways a permanent life insurance policy’s cash value might be used.

- Helping finance the purchase of a larger ticket item, such as a vehicle.

- Helping cover a child's educational expenses.

- Helping supplement other retirement income sources.

- Helping provide an income bridge so an individual can delay the start of Social Security benefits.

- Helping with the down payment to purchase a home.

- Helping insulate aginst the full impact of market volatility in retirement, by temporarily cash values for spending needs instead of market-based investments (helping to avoid "selling low").

- Many, many more ways...

Creditor protections

Nobody likes to think of the possibility of being used. However, lawsuits are a common situation in modern society. In addition to the other benefits of permanent life insurance, policies may receive creditor protection under each state’s laws and the federal bankruptcy code. That protection varies by state and can depend on whether bankruptcy is involved. Different rules may also apply to cash values and death benefits.

Because creditor protection rules can very widely between states, we encourage you to consult with your attorney for personalized guidance on the creditor protection rules in your state and associated with your individual circumstances.

COUNTRY Trust Bank ® Financial Planning Consultants

- Bryan Daniels, CFP®, MPAS®, ChFC®, CLU®, AFFP, AWMA®, ADPA®, CMFC®

- Nick Erwin, CFP®, BFA®, ChFC®, CLU®, AFFP

- Scott Jensen, CFP®, ChFC®, CLU®, RICP®, AFFP

- Lorraine Zenge, AFFP

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

Life insurance policies issued by COUNTRY Life Insurance Company® and COUNTRY Investors Life Assurance Company®, Bloomington, IL.

*Policy loans, withdrawals, and partial surrenders decrease the cash value and death benefit of the policy.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

This information is not intended as and should not be construed to provide tax or legal advice. It is intended as an educational starting point to help you better understand the topic being presented. COUNTRY Trust Bank and its employees do not provide tax advice, nor should you use the information here to advise clients or prospects on their personal tax situation. This information may omit some important aspects of tax or legal conditions the clients or prospect may face, which is why you should always recommend that they seek out the advice of qualified tax or legal professionals of their own choosing.