Market and Economic Outlook - Released 12/31/23

Key Takeaways:

- Inflation has come down significantly. Navigating the interest rate mountain down now becomes the focus of the Federal Reserve.

- The “Magnificent 7” have become an ever-larger portion of the S&P 500 in 2023 driving returns this year. However, reversion to the mean played a large role after significant underperformance in 2022.

- Lower interest rates could lead to price appreciation on intermediate and longer-term bonds. Those waiting on the sidelines in money market accounts may not get the same returns in the future as interest rates fluctuate.

Each year there are specific events which can distract investors from keeping a long-term focus. 2023 was no different as, in just one year, we navigated a banking crisis, inflation concerns, the mass awareness of artificial intelligence technology and geopolitical strife in Europe and the Middle East, just to name a few. Through it all, we found success in the approach we have always taken, which is to stay invested for the long term while trying to take advantage of market dislocations to add value for our clients.

You could say, from our perspective, investing is boring over lengthier periods but is filled with many events in the short term which can seem more dramatic. A prudent investor always needs to consider if these events will be impactful in the next 1, 3 or 5 years or whether they are merely attention-grabbing headlines today.Often, those who get swept up in the day's market moving news hand over their wealth to the investors who are focused on the long-term rewards.

As a new year begins, we remain measured on our outlook for risk assets. As with any year, we expect there to be twists and turns, but our mission is to look through the fray. We believe the impacts of much higher borrowing costs will influence economic activity. Unless there are some significant surprises in store, it appears the Fed may be done with rate increases this cycle. While this should be viewed very positively, much of it appears to already be reflected in stock prices in our view. We believe it makes sense to be more neutrally positioned with a bias towards bonds over stocks in multi-asset portfolios.

Have lagged effects come through?

The economy has done a great job of enduring a fast interest rate hiking cycle through the year and will likely no longer have to contend with rising interest rates. That does not mean the economy is finished dealing with the impacts of what has now been put in place. There is still the concern around the lagged effects of monetary policy. According to an article by economist Bill Dupor of the St. Louis Federal Reserve, the effect of monetary policy on the economy ranges anywhere from 4 to 29 months.† We may have seen most of the effects come through, or we may have only seen the effects of a handful of rate hikes.

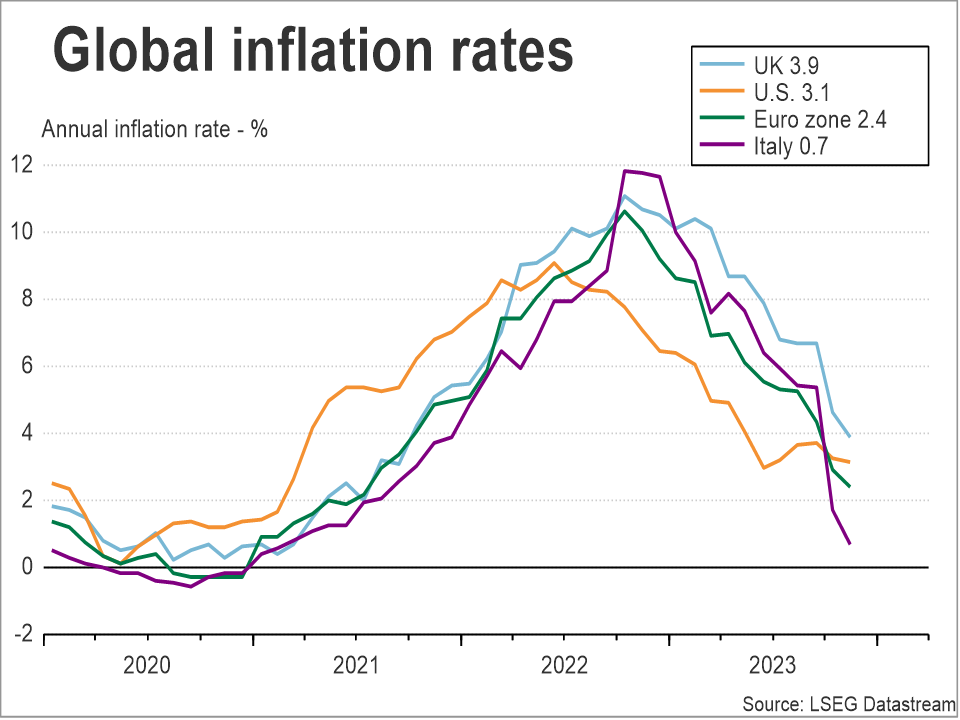

Global inflation has come down almost as quickly as it went up with U.S. CPI at 3.1% (down from a peak of 9.1%), the UK down to 3.9% (from a peak of 11.1%), and the euro zone down to 2.4% (from a peak of 10.6%). (Figure 1) The Personal Consumption Expenditures (PCE) price index, which is the Fed’s preferred gauge for inflation, is at 2.6%. Now central banks must, at some point, do the same with their target rates. The question now becomes “When and for how long”? We believe if we do see a recession next year, it will be shallow. We came into 2023 with a few items to watch: the Fed and inflation, consumer health and employment, and global supply chains. In 2024, here are a few items to watch.

Figure 1

Figure 1

1. Interest Rates

It is said the most dangerous part of climbing a mountain is not the ascent, but the descent. Once reaching the peak, you are exhausted and now must climb down and do it carefully. The Fed now must balance how long they keep interest rates at their peak before “interest rate fatigue” sets in. They must be careful not to keep interest rates high for too long as it may push the economy over into a deeper recession, ehile at the same time keeping rates at a level that will continue to bring inflation down. Yes, inflation has come a long way, however, it is still well above their 2% target and there is more work to be done. We believe this can be accomplished without a significant downturn but will want to monitor the lagged impacts of prior increases along the way. International countries will have some of the same issues to contend with in 2024.

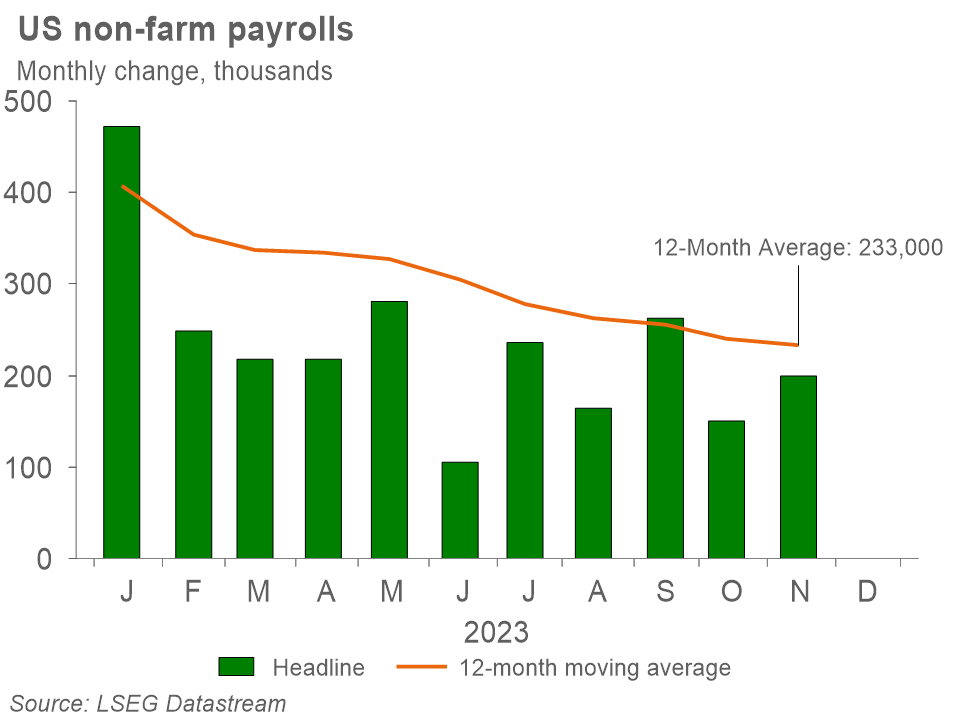

2. The Labor Market

The labor market has remained stubbornly tight with the unemployment rate at 3.7% and jobless claims remain in the low 200,000’s. Since July, the 4-week moving average has been below 250,000 and job openings as of the end of October were at 8.7 million indicating job supply still exceeds demand. Payroll growth has slowed throughout the year with the 12-month average at 233,000 at the end of November (Figure 2), and the Fed believes that this supply/demand imbalance will continue to work itself out with projections for the unemployment rate to end 2024 at 4.1%. Wage growth has also come down but remains higher than the longer-run average. Engineering a soft landing will require bringing the labor market back into balance while keeping the unemployment rate from increasing significantly.

Figure 2

Figure 2

3. The Consumer

Consumer spending drives about two-thirds of GDP, and the consumer has been very resilient in the face of inflation. This led to strong real GDP over the first three quarters of 2023 with the third quarter’s final figure at an annualized rate of 4.9% and the fourth quarter expected to be strong as well. Retail sales slipped in October but bounced back in November bringing the year-to-date retail sales figures 3.2% higher than the same period last year and roughly in-line with inflation. While the consumer has remained strong, excess savings built during the pandemic have come down which could make it more difficult for consumers to spend as they have done in the past. This drawdown can be seen in credit card balances and delinquencies, both of which have trended higher. Whether the trend of resilient consumer spending continues will, in part, be determined by the labor market.

The magnificent 7, or mean reversion?

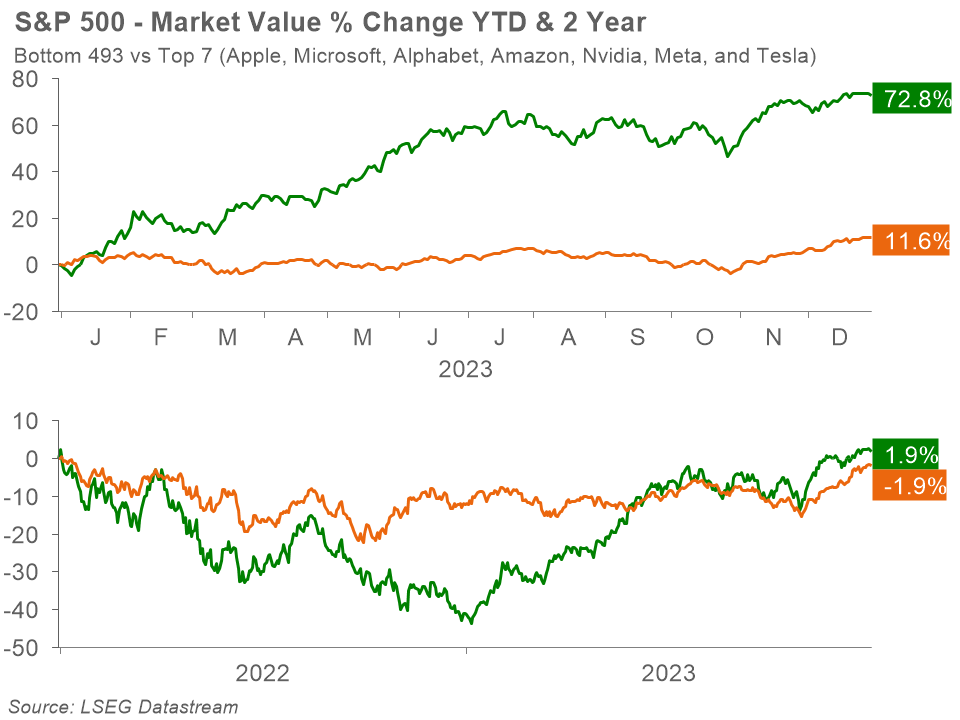

When looking at major stock market returns for 2023, especially in the United States, we saw robust double-digit returns. In fact, the S&P 500’s total return was 26.3% for the year after a challenging 2022 that saw the benchmark decline over 18%. As has been a constant theme in financial news and headlines throughout the year (including our own Market and Economic Outlook), these returns were dominated by 7 of the largest stocks in the index that have been commonly referred to as the “Magnificent 7”. This dominance has resulted in these stocks becoming nearly 30% of the S&P 500 which greatly magnifies their influence on the underlying price moves of the index.,

When the calendar year shifts, it is easy to reset perceptions and notions as it relates to many things. For financial markets, looking at returns in the vacuum of a calendar year often does not tell the whole story. If we look back further to the beginning of 2022, we find that while those top 7 stocks outperformed the other 493, it was far less than the disparity we saw in 2023 alone. (Figure 3)

Figure 3

Figure 3

While the rally in the Magnificent 7 this year was partially driven by future growth expectations related to the proliferation of Artificial Intelligence (AI), we also believe it was a rebound in these stocks recovering from troughs seen very late in 2022. As these stocks have rallied, their valuation has gotten more expensive even when factoring in heighted future growth expectations. We believe valuation matters when selecting individual stocks, and even more importantly, we believe diversification matters. In a year like 2022 where these 7 were down nearly 40%, diversification helped to smooth the impact of these stocks in a broader portfolio while still allowing portfolios to participate in the upside this year.

We enter 2024 with a preference for stocks that are smaller in size to the Magnificent 7 but are trading at more attractive valuations. At this time, we favor mid-cap companies as they remain more attractively valued to their large cap peers, but we believe they are also better positioned from a debt and profitability standpoint over small-cap stocks. While we have our preferences towards mid-cap, we still believe diversification across market caps, as well as globally, continues to make sense in an effort to create smoother results across time that extends beyond just one calendar year. In 2023, small cap stocks were up 16.9% and international stocks were up 16.2%.

Bond Market Tug of War

U.S. Treasury interest rates peaked in October, reversed course quickly in November, and ended the year near levels where they started 2023. Despite the volatility in rates, it turned out to be a much better year for bond investors than 2022 with the Bloomberg Aggregate index returning 5.7% for the year. This was due to higher income payments and investors willing to pay a higher price for bonds with credit risk.

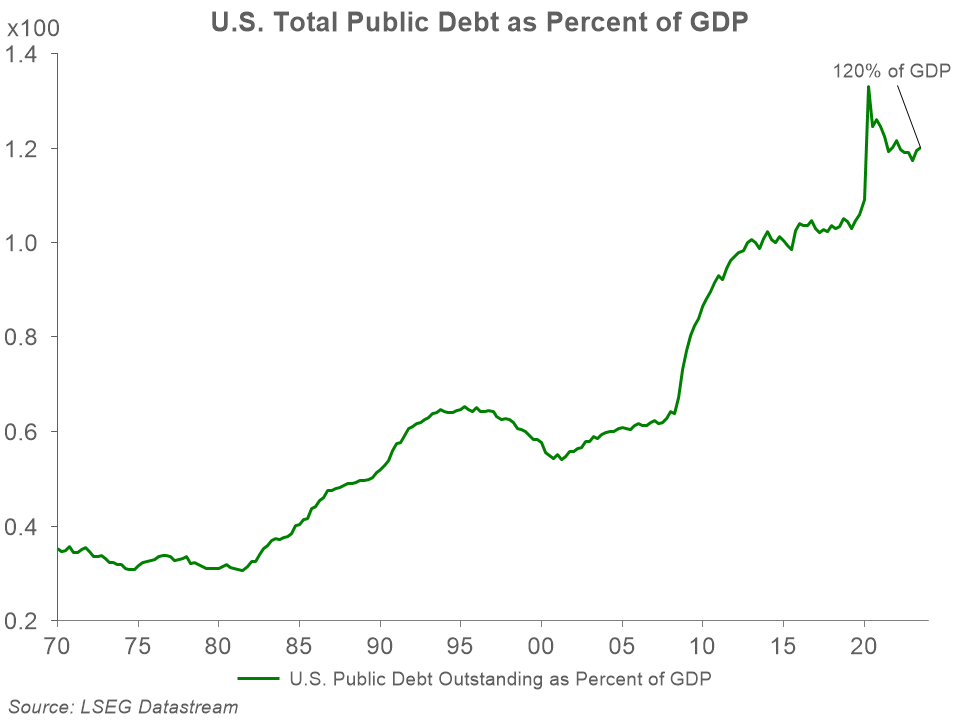

The driver of interest rate volatility during the year was the tug of war between slowing growth and inflation uncertainty. We are not convinced longer-term rates are going significantly lower in the near term as we believe inflation may take longer than expected to moderate. However, the lagging effects of higher interest rates could continue to dampen economic activity, putting downward pressure on rates.

One factor which could lead to interest rates remaining elevated is issuance of Treasury bonds to cover the federal government’s budget deficit. The market’s ability to absorb this supply, along with skepticism the deficit will be controlled, could impact rates going forward. Total U.S. debt has grown faster than the total U.S. economy for over a decade, and at a certain point, investors may demand ever-increasing yields. (Figure 4)

Figure 4

Figure 4

Fed’s Job Done?

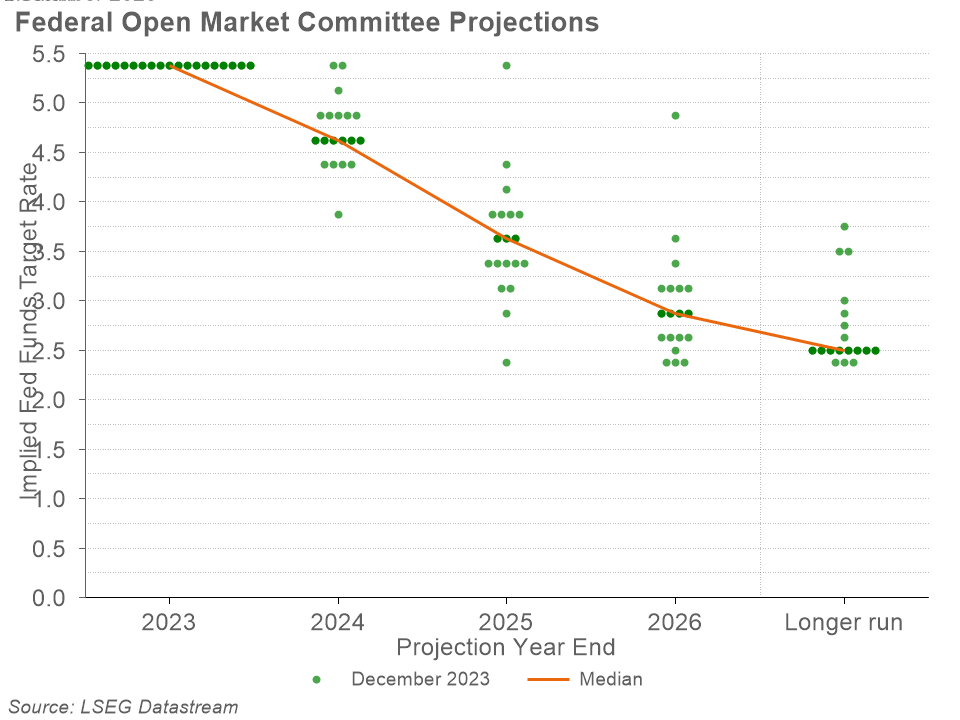

A moderating labor market and forecasts for cooling inflation have allowed the Fed to express a more accommodative tone. Many investors now believe the Fed will pivot and lower the federal funds rate at the March meeting. According to the Fed’s outlook for the federal funds rate, also known as the Dot Plot, a majority of Federal Reserve members are projecting multiple rate cuts during 2024 and beyond. (Figure 5)

Figure 5

Figure 5

Lower interest rates could lead to significant price appreciation on intermediate-term and longer maturity bonds and yields on cash could be lower than today. Bond investors waiting on the sidelines in money market accounts have no guarantee how long today’s short-term yields will last.

While we continue to like investment grade bonds with yields above what we have seen over the last 10 years, credit spreads, or the difference in the yield of two bonds with the same maturity, remain tight. Spreads have tightened due to lack of concern about a recession or negative credit events. We are continuing to move client bond portfolios into higher quality, intermediate bonds as we do not believe we are being paid to take additional credit risk.

The Bottom Line

While we do not know what events will dominate investor attention during 2024, we are confident they will be numerous. We will do our best to navigate the noise and allocate client assets wisely. In our view, riskier assets like stocks are priced fairly. Bonds remain a compelling opportunity at today’s starting yields. This makes us measured in our approach today within multi-asset portfolios but will be flexible as the year unfolds. In our view, clients being able to stick to their investment plan with the assistance of a trusted financial advisor may allow them to achieve their goals today, tomorrow, and beyond.

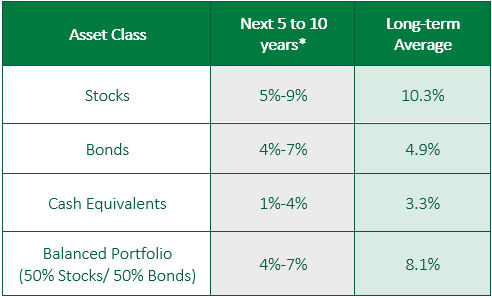

Figure 6

Figure 6

*Forecasted average annual returns of COUNTRY Trust Bank Wealth Management

Source: Morningstar and COUNTRY Trust Bank® - See Definitions and Important Information below

COUNTRY Trust Bank® Wealth Management Team

- Troy Frerichs, CFA - VP, Investment Services

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- G. Ryan Hypke, CFA, CFP® - Portfolio Manager

- Beau Lartz, ChFC® - Investment Analyst

- Cody Behrens, ChFC® - Investment Analyst

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Michelle Beckler - Investment Analyst

- Samantha Reichert - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

All information is as of the report date, unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Definitions and Important Information

Figures 1-6: Chart data comes from LSEG (formerly Refinitiv) DataStream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis.

Figure 6: The long-term average return data comes from Morningstar and is based upon compound average annual returns for the period from 1926 through December 31, 2023. Stocks are represented by the Ibbotson® Large Company Stock Index, which is comprised of the S&P 500® Composite Index from 1957 to present, and the S&P 90® Index from 1926 to 1956. Bonds are represented by the Ibbotson® U.S. Intermediate-Term Government Bond Index. Cash Equivalents are represented by the 30-day U.S. Treasury bill. The “Balanced Portfolio” is representative of an investment of 50% stocks and 50% bonds rebalanced annually. Forecasted stock returns include small capitalization and international equities. Forecasted bond returns include investment grade corporate bonds. These returns are for illustrative purposes and not indicative of actual portfolio performance. It is not possible to invest directly in an index.

† Dupor, Bill. Examining Long and Variable Lags in Monetary Policy, Federal Reserve Bank of St. Louis, 24 May 2023, https://www.stlouisfed.org/publications/regionre-economist/2023/may/examining-long-variable-lags-monetary-policy

The FTSE 3 Month US T Bill Index Series is intended to track the daily performance of 3-month US Treasury bills. The indexes are designed to operate as a reference rate for a series of funds.

Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies, and they may be expected to do so in the future.

International investing involves risks not typically associated with domestic investing, including risks of adverse currency fluctuations, potential political and economic instability, different accounting standards, limited liquidity, and volatile prices.

Fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher- rated securities.

The yield curve plots the interest rates of similar-quality bonds against their maturities. The most common yield curve plots the yields of U.S. Treasury securities for various maturities. An inverted yield curve occurs when short-term rates are higher than long-term rates.

The federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. The Federal Open Market Committee, which is the primary monetary policymaking body of the Federal Reserve, sets its desired target range.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas.

Credit spreads measure the difference in yields between bonds with the same maturity but different credit quality.

The price-to-earnings ratio is a valuation ratio which compares a company's current share price with its earnings per share (EPS). EPS is usually from the last four quarters (trailing P/E), but sometimes it can be derived from the estimates of earnings expected in the next four quarters (projected or forward P/E). The ratio is also sometimes known as "price multiple" or "earnings multiple."

PCE is an estimated total of personal consumption expenditures compiled by the U.S. government monthly as one way to measure and track changes in the prices of consumer goods over time. PCEs are household expenditures. PCEs as well as personal income statistics and the PCE Price Index are released monthly in the Bureau of Economic Analysis (BEA) Personal Income and Outlays report.

The JOLTS report tells us how many job openings there are each month, how many workers were hired, how many quit their job, how many were laid off, and how many experienced other separations.

Brent crude oil is a type of light sweet crude oil that is used as a global benchmark for global oil prices. WTI is the main oil benchmark for North America as it is sourced from the United States, primarily from the Texas Permian Basin.

The S&P 500® Index is an unmanaged index consisting of 500 large-cap U.S. stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index that covers the USD-denominated, investment-grade, fixed rate, taxable bond market of securities. The Index includes bonds from the Treasury, Government-Related, Corporate, MBS, ABS, and CMBS sectors.