4 Ways Rising Interest Rates Could Impact You

Our latest COUNTRY Financial Security Index shows Americans worry about interest rates and how they could be affected.

Feeling good about money

More than 6 in 10 Americans are feeling good or excellent about their financial security and are able to set aside money for savings and investments.

COVID-19 having little impact on financial security

Just 2 in 10 Americans say COVID-19 has negatively impacted their financial security in the past year.

Who thinks they're prepared, what are the top priorities, and how many are looking for savings on their insurance? Find out with the results of our survey.

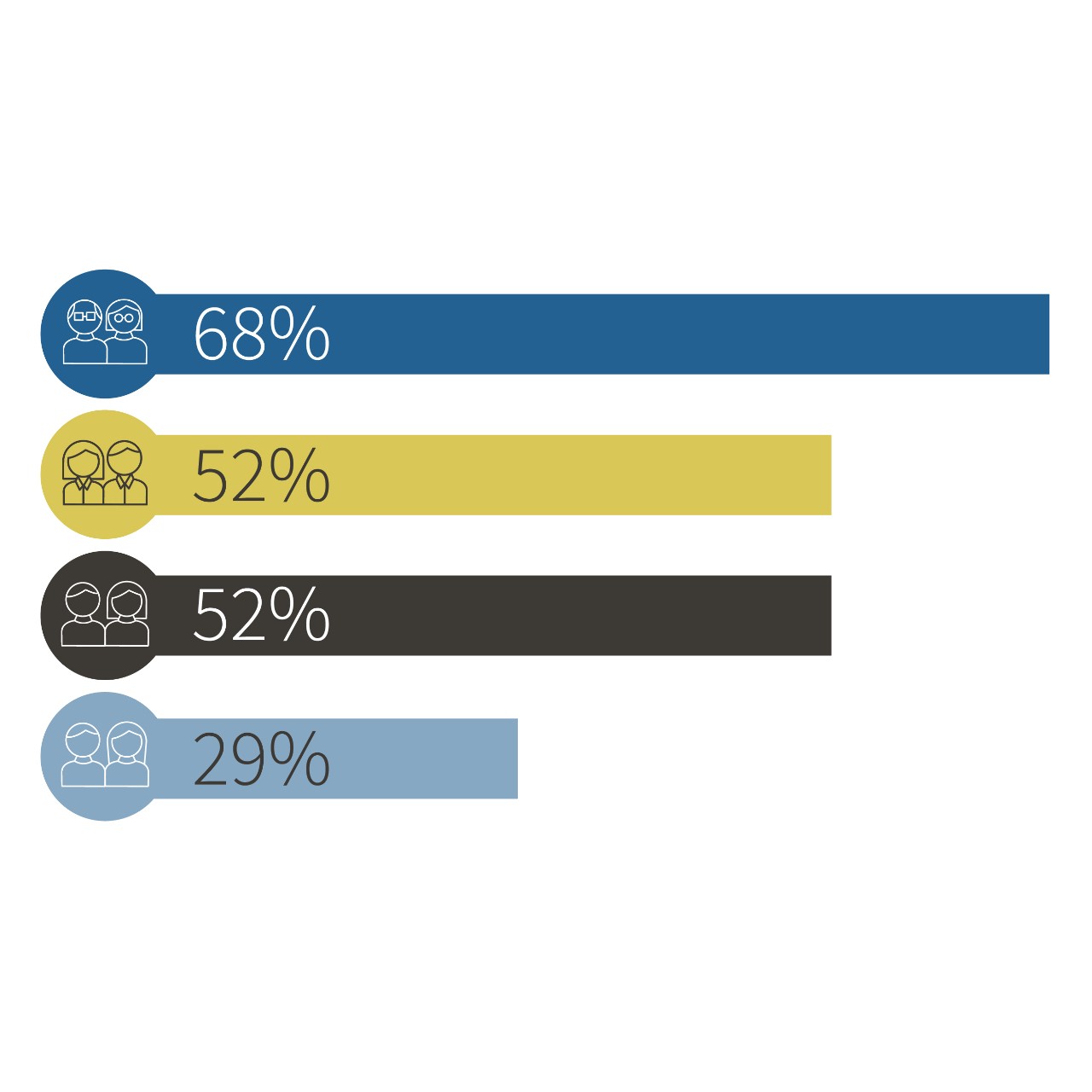

Boomers – 68%

Gen X – 52%

Millennials – 52%

Gen Z – 29%

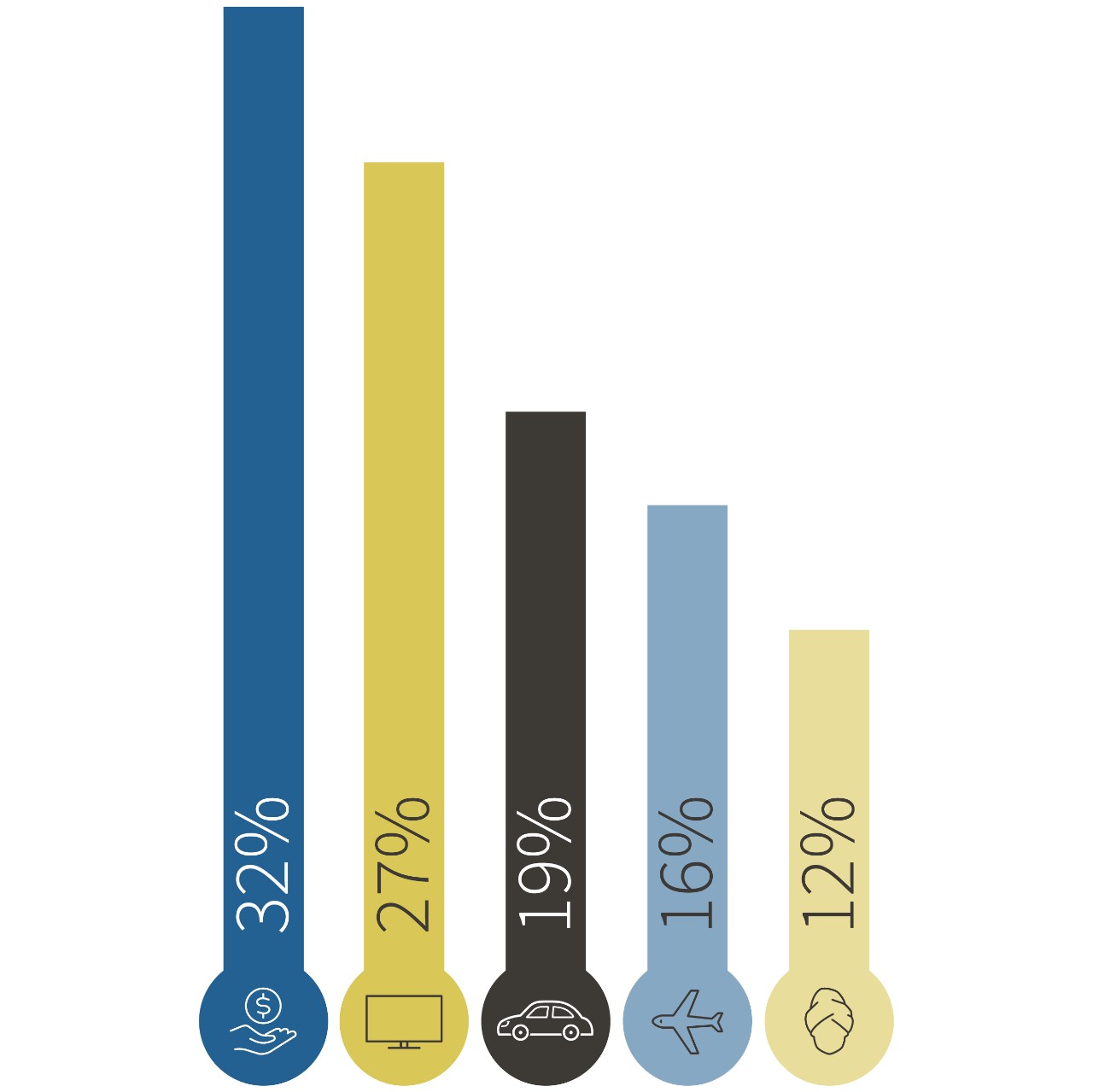

Savings – 32%

Streaming services/TV – 27%

Travel: by car – 19%; by plane – 16%

Pampering at spas and salons – 12%

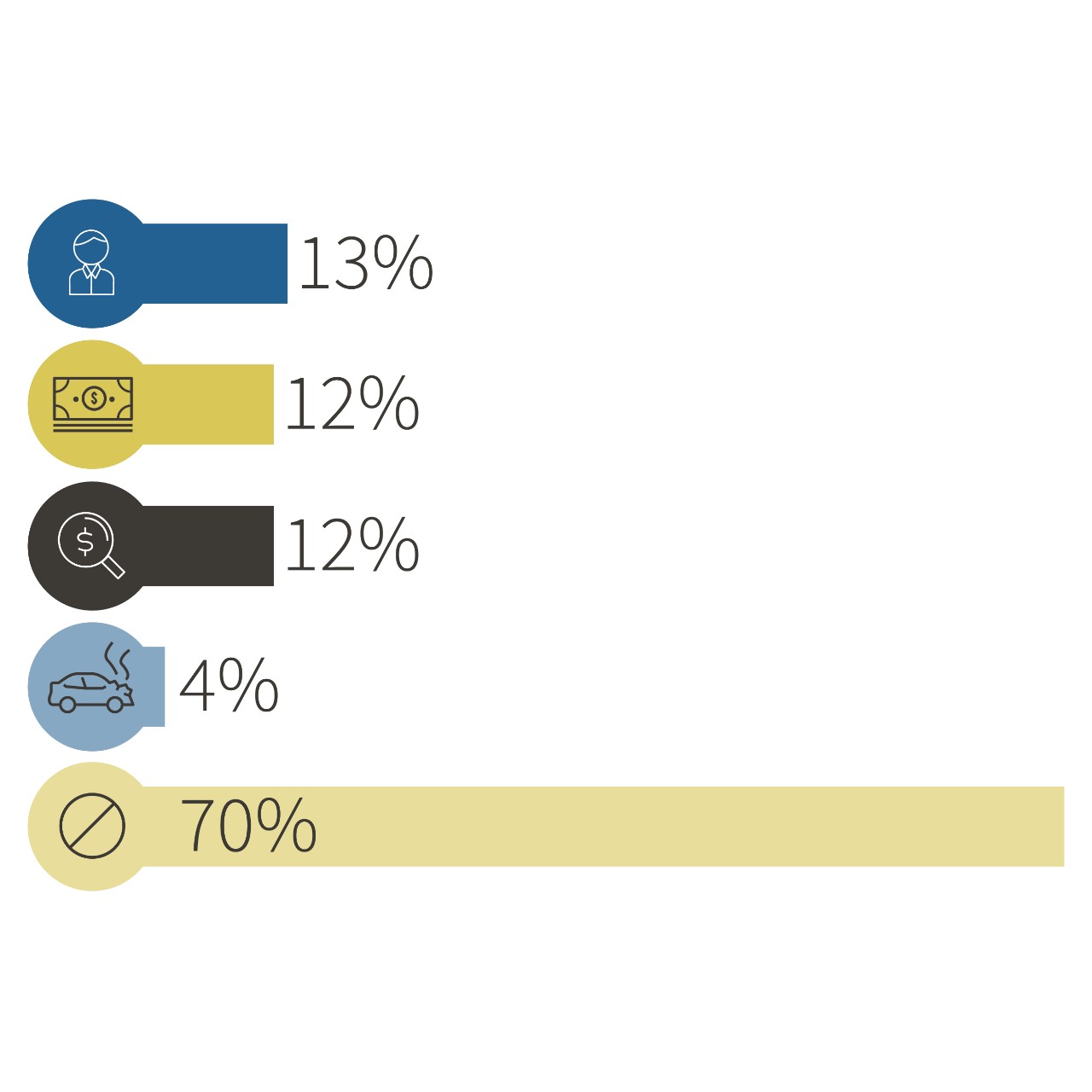

Review my coverage with agent – 13%

Ask about available discounts – 12%

Shop with another provider – 12%

Ask about changing deductible – 4%

Take no action to find savings – 70%

More than half of Americans say the overall state of the economy has caused them to cut back on spending to make ends meet (52%) in the last six months, with 18% citing significant cuts. If you are feeling like others who are putting less money into savings (38%) and even tapping into savings (30%) to make ends meet, consider these options:

During difficult economies, you need to set priorities in your budget. Track your spending to find ways to save. Use this budget calculator to help.

Live on less than you earn – Combine steps 1 and 2 to balance your budget.

Commit to saving - 42% of Americans surveyed say they will still prioritize saving even if a recession happens and if inflation continues to rise.

Maintain your emergency fund - 38% of those surveyed have prioritized their emergency fund.

Spend less, save more and prepare for the future – all the right goals. But trips to the grocery store and gas station combined with rising utility bills challenge your ability to achieve them. Meet with your representative to discuss options.

Our latest COUNTRY Financial Security Index shows Americans worry about interest rates and how they could be affected.

Five ways to enhance your retirement savings.

Prepping for a financial emergency.

1The COUNTRY Financial Security Index® survey of 1,000 U.S. adults, fielded by market researcher Ipsos.

2Financial planning professionals with COUNTRY® Trust Bank (CTB) and its Investment Solutions Representatives, who provide marketing, solicitation, and client assistance on CTB’s behalf; sales of products by Registered Representatives of COUNTRY® Capital Management Company. The specific team(s) involved will vary by need.

The COUNTRY Financial Security Index survey has measured Americans' feelings about their personal financial security since 2007. Surveys are conducted using Ipsos' KnowledgePanel®— a national, probability-based panel, designed to be representative of the general population and includes responses from approximately 1,330 U.S. adults for national surveys. The margin of sampling error for a survey based on this many interviews is approximately +/- 3.2 percentage points at the 95% confidence level. See the full results.

Auto and home insurance policies issued by COUNTRY Mutual Insurance Company®, COUNTRY Preferred Insurance Company® and COUNTRY Casualty Insurance Company®, Bloomington, IL.

NOT FDIC-INSURED

May lose value

No bank guarantee

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Registered broker/dealer offering securities products: COUNTRY® Capital Management Company, 1711 General Electric Rd, PO Box 2222, Bloomington, IL 61702-2222, 1-866-551-0060. Member FINRA. Read our full Customer Relationship Summary and Investor Handbook.