COUNTRY Trust Bank Special Report on Market Volatility - Released 3/11/20

Key takeaways

- U S. stocks were sent reeling during the week of February 24th, 2020 as fears related to the spread of the coronavirus were brought to the forefront of investors’ minds.

- We feel stocks are currently offering better value than they did a few weeks ago for Journey Series Clients. Within multi-asset portfolios, we are now targeting a slight overweight to stocks versus our long-term recommended weights.

- We believe Journey Series Clients should consider making changes to their target allocations when their investment goals change, or when their personal situation changes, not because of headlines causing fear in financial markets

The COVID-19 disease (caused by the coronavirus) thought to be sourced from a seafood market in Wuhan, China has spread across the globe afflicting more than 100,000 people and resulted in nearly 4,000 deaths.1 Extraordinary measures have been put in place to limit its spread throughout China and the rest of the world, but despite these efforts we have recently seen thousands of cases occurring in Italy, South Korea, and other countries.2 The virus has spread worldwide and is now impacting U.S. citizens.

U S. stocks were sent reeling during the week of February 24th, 2020 as fears related to the spread of the coronavirus were brought to the forefront of investors’ minds. The S&P 500® dropped 11.5% in 5 trading sessions, marking the worst one week sell off since 2008.

Adding to the uncertainty, it was believed an OPEC coalition including Russia, would continue to cut crude oil production in light of reduced economic activity due to the coronavirus outbreak. However, unexpectedly, Russia refused to participate in the production cuts on March 6. In retaliation, Saudi Arabia began selling crude oil at discounted prices, which led to fears of irrational pricing in the marketplace.

Market volatility

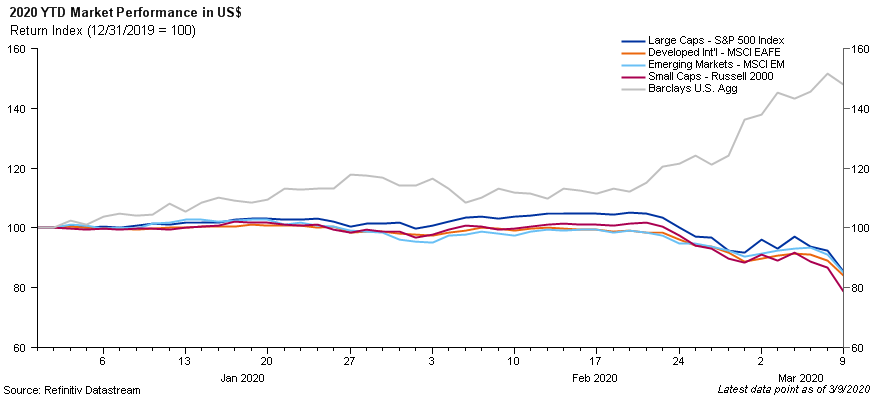

During trading on March 9, the S&P 500 flirted with a 20% drop from the record high set in mid-February, nearly signaling an end to the longest running bull market in history, which began in 2009. Investors have flocked to the safety of U.S. Treasury bonds. Yields have plummeted to record lows with the 10-year treasury yield now well under 1%. Investment grade bonds, as measured by the Bloomberg Barclays U.S. Aggregate Bond index, once again provided support to multi-asset portfolios returning +6.07% year to date as of 3/9/20 (Figure 1).

Figure 1

Figure 1

We continue to believe it doesn’t make sense to panic during times like this. In our most recent “Market and Economic Outlook” at the end of December, we discussed concern about greater market volatility heading into 2020. The factors we mentioned were the upcoming election, trade tensions, and social unrest. However, unexpected events like the coronavirus can often lead to greater uncertainty. Each year, there are reasons to cause investors to panic and we believe the coronavirus is the latest negative event (Figure 2).

Figure 2

Figure 2

What we are seeing

Volatility creates opportunity in investing. Surveying the current landscape, we feel stocks are currently offering better value than they did a few weeks ago for Journey Series Clients. Within multi asset portfolios, we are now targeting a slight overweight to stocks versus our long term recommended weights. Company earnings estimates are likely to be volatile. However, we believe certain sectors of the U.S. stock market are compensating investors for this risk. High quality bonds do not provide attractive levels of income today but remain an important diversifier against stock market risk. Within fixed income, we are starting to see better value in below investment grade bonds, preferred stock issued by financial services companies, and emerging market bonds. We are actively in the process of rebalancing Journey Series portfolios to take advantage of these opportunities.

What investors should do

While it may be too soon to measure the ultimate impact, the coronavirus has on the global economy, sticking to your long-term financial plan is the best approach. However, for long term investors, we believe Journey Series Clients should consider making changes to their portfolio when their investment goals change, or when their personal situation changes, not because of headlines causing fear in financial markets. We will continue to monitor the economic impacts of the coronavirus and will make investment decisions as needed with the best interest of our clients being our top priority.

COUNTRY Trust Bank wealth management team

- Chelsie Moore, CFA, CFP® - Director, Wealth Management & Financial Planning

- Jeff Hank, CFA, CFP® - Manager, Wealth Management

- Kent Anderson, CFA - Portfolio Manager

- Jonathan Strok, CFA - Portfolio Manager

- Weston Chenoweth - Investment Analyst

- Molly Ruddy - Investment Analyst

- Jamie Czesak - Investment Analyst

Looking for help navigating your future?

Set up a meeting with your local rep to review your current policies and make sure they're up to date. We pulled together some less obvious reasons to adjust your coverage.

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

NOT FDIC-INSURED

May lose value

No bank guarantee

All information is as of the report date unless otherwise noted.

This material is provided for informational purposes only and should not be used or construed as investment advice or a recommendation of any security, sector, or investment strategy. All views expressed and forward-looking information, including forecasts and estimates, are based on the information available at the time of writing, do not provide a complete analysis of every material fact, and may change based on market or other conditions. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Unless otherwise noted, the analysis and opinions provided are those of the COUNTRY Trust Bank investment team identified above and not necessarily those of COUNTRY Trust Bank or its affiliates.

Diversification, asset allocation and rebalancing do not assure a profit or guarantee against loss. All market indexes are unmanaged, and returns do not include fees and expenses associated with investing in securities. It is not possible to invest directly in an index.

Investment management, retirement, trust and planning services provided by COUNTRY Trust Bank®.

Past performance does not guarantee future results. All investing involves risk, including risk of loss.

Definitions and Important Information

The S&P 500® Index is an unmanaged index consisting of 500 large-cap stocks. Since it includes a significant portion of the total value of the market, it also considered representative of the market. The index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

The Barclays U.S. Aggregate Bond Index is an unmanaged index that covers the USB-denominated, investment-grade, fixed rate, taxable bond market of securities. The Index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS sectors. It is not possible to invest directly in an index.

The MSCI EAFE Index is broadly recognized as the pre-eminent benchmark for U.S. investors to measure international equity performance. It comprises the MSCI country indexes capturing large and mid-cap equities across developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 emerging market countries. The index free float-adjusted market capitalization index and represents 13% of global market capitalization.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. It is not possible to invest directly in an index.

1 https://www.hopkinsmedicine.org/health/conditions-and-diseases/coronavirus

Figure 1: Chart data comes from Refinitiv (formerly Thomson Reuters) Datastream, a powerful platform that integrates top-down macroeconomic research and bottom-up fundamental analysis.

Figure 2: Chart data comes from MFS Investment Management.