December 1, 2020

Withstanding the Storm: Americans’ Feelings of Financial Security Stay at Pre-Pandemic Levels Despite Impacts of COVID-19 and the Election

New COUNTRY Financial survey finds that majority of Americans developed good personal finance habits in 2020 and are looking to improve finances in the new year ahead

BLOOMINGTON, Ill. – December 1, 2020 –While our country fights a global pandemic, battles an unsettled economy, and reckons with the ramifications of a dramatic election, Americans’ levels of financial security tell a surprisingly calmer story as the tumultuous 2020 comes to a close.

A new COUNTRY Financial Security Index, fielded post-election, reveals Americans’ overall sentiment of financial security has remained constant over the past year. Fifty-five percent of Americans rated their financial security positively, compared to 53 percent who answered the same this time last year, prior to the pandemic.

However, this does not mean Americans have been ignoring their finances. Many reported taking a hard look at the implications of the year’s events on their personal finances in an effort to continue building financial security for the future. As we move into 2021, many Americans feel hopeful despite the turmoil of the past year. Thirty-eight percent of Americans say they are optimistic about their financial outlook in 2021, and a similar number expect their financial situation to stay the same (36 percent).

“There are many reasons Americans could be feeling good about their financial futures right now,” said Troy Frerichs, Vice President of Investment Services at COUNTRY Financial. “Savings rates have gone up, we are hearing positive news about a COVID-19 vaccine and the stock market is at an all-time high. It is encouraging to see that even though many are suffering from pandemic fatigue and there is so much that is out of their control, Americans are taking steps to improve their financial security now and in the new year.”

The impact of COVID-19-19 and the election on Americans’ feelings of financial wellness

Americans endured a pandemic, a volatile election and many natural disasters in 2020, but the pandemic has had the greatest impact on their feelings about their finances (40 percent), followed by the election results (30 percent). About one in five (21 percent) said neither of these events had an impact on their feelings of their financial situation.

Those who report feeling less financially secure overall are significantly more likely to say COVID-19 had a negative impact on their financial security compared to those who report feeling more secure overall (51 percent and 19 percent, respectively). Additionally, nearly one in four (39 percent) of Millennials and Gen Z said the pandemic has negatively affected their finances compared to 24 percent of Baby Boomers.

When asked how the election has impacted their feelings of financial security, Americans’ responses are varied: 36 percent said the election results had no impact, 28 percent of Americans said that the results make them feel less confident about the future of their financial security, 18 percent said they feel more confident, and 18 percent don’t know. Three in ten Boomers (32 percent) reported feeling less confident about their finances after the election, compared to 23% of Millennials/Gen Z and 28% of Gen X.

“It’s not surprising to see the differences in feelings among generations,” said Frerichs. “Millennials are the first generation that is not expected to earn more than their parents did. They were hit hard in the 2008 recession and continue to struggle today. Many in the Boomer generation have more savings and could be tied more closely to the stock market and taxes.”

Americans develop good personal finance habits in 2020

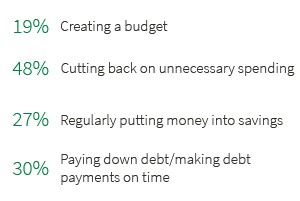

Even through the economic instability of the COVID-1919 pandemic, many Americans still found a way to improve their financial stability by developing personal finance skills, especially in the areas of controlling spending, paying down debt and regularly putting money into savings (See chart).

Seventy-six percent of Americans say that they have been able to gain or further develop at least one personal finance skill this past year, including:

- Cutting back on unnecessary spending (48 percent)

- Paying down debt and making debt payments on time (30 percent)

- Regularly putting money into savings (27 percent)

- Regularly contributing to a 401(k) or other retirementaccount (19 percent)

- Creating a budget (19 percent)

- Building an emergency fund (15 percent)

“Paying down debt, controlling spending and saving money are all important in tough times, so it’s encouraging to see people developing new skills that can be used in the coming years,” continued Frerichs. “While the additional savings that Americans hav accrued should buffer spending, we still encourage people to keep up the good habits they have adopted in 2020 and continue to invest in their long-term savings and future.”

Additionally, more than half of Americans (55 percent) were able to put aside money for savings andinvestments in 2020, and surprisingly, 36 percent of those who saved said the pandemic affected their finances in a negative way.

However, some Americans report having financial regrets in the last year; their top two are spending too much on unnecessary purchases (20 percent) and not putting aside enough money for an emergency fund (17 percent). Respondents with an income of less than $50K were more likely than those with an income of $50K or more to regret not putting enough money aside for an emergency fund (27 percent and 13 percent, respectively).

Looking forward to 2021: Americans’ top financial goals

Americans are feeling optimistic about their finances in the new year. In fact, 38 percent of Americans believe that their finances will improve in 2021, while 36 percent believe that their finances will stay the same. Only 18 percent believe they will worsen.

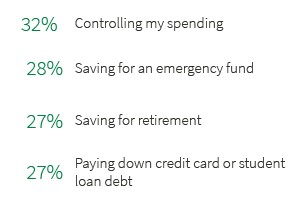

When asked what their top financial goals are for 2021, 32 percent of Americans said they wanted to control their spending, 29 percent said saving for an emergency fund, 27 percent said paying down credit card or student loan debt and 24 percent said saving for retirement (see chart). Others had more purchase-oriented goals, including purchasing a car (13 percent) or a home (11 percent). Twenty-one percent said that they did not have financial goals for 2021.

“The pandemic presents an opportunity for Americans to regroup and get on a good financial track. Many have recognized that now is the time to address their financial weak spots and put a game plan in place,” said Frerichs. “The financial industry has seen more people wanting to talk to a professional about their goals. A financial professional can help build a personalized strategy that is tailored to address a person’s specific needs, versus a one-size-fits-all solution.”

To learn more, visit countryfinancial.com.

Media contact

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

About the COUNTRY Financial Security Index®

Since 2007, the COUNTRY Financial Security Index has measured Americans' sentiments of their personal financial security. The Index also delves deeper into individual personal finance topics to better inform Americans about the issues impacting their finances. View past surveys in the COUNTRY Financial Security Index newsroom.

The COUNTRY Financial Security Index was created by COUNTRY Financial and is compiled by Ipsos an independent research firm. Surveys were conducted using Ipsos' KnowledgePanel®, a national, probability-based panel designed to be representative of the general population and includes responses from approximately 1,330 U.S. adults for national surveys. The margin of sampling error for a survey based on this many interviews is approximately +/- 2.71 percentage points with a 95 percent level of confidence.

About COUNTRY Financial®

The COUNTRY Financial® group (www.countryfinancial.com) serves about one million households and businesses throughout the United States. It offers a wide range of financial products and services from auto, home, business and life insurance to retirement planning services, investment management and annuities.

Visit COUNTRY Financial on Twitter @HelloCountry, on Facebook @COUNTRYFinancial and on Instagram @countryfinancial.

About Ipsos

Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com