October 12, 2023

Retirement Confidence Report: Those Who Feel On-Track for Retirement are Diversifying Assets and Working with a Financial Advisor

Bloomington, IL. – Six in ten Americans expect to have enough money to retire comfortably, according to a survey from COUNTRY Financial. Those who say they feel on-track for retirement report the following financial moves contributed to their success:

- Having a diversified mix of assets- stocks, bonds and other assets (87%)

- Working with a financial advisor (86%)

- Managing their investments themselves (74%)

- Creating a plan and sticking to it (73%)

- Having online tools to view their progress and manage their investments (68%)

- Saving and investing an amount they’re comfortable with (68%)

“The process of identifying the financial moves that are key to a successful retirement starts with a plan,” says Chelsie Moore, Director of Wealth Management at COUNTRY Financial. “Once you’ve identified what a successful retirement looks like in your situation and taken pulse of where you’re at now, a financial advisor can create a custom plan for accomplishing your goals.”

How much money do you need to save to retire comfortably?

According to the survey, Americans who expect to have enough money to be able to retire comfortably are significantly more likely to have $100,000 or more saved for retirement savings than their less confident counterparts (51% and 8%, respectively). Among those who are confident in their ability to retire, 26% say they have $100,000 to $499,999 saved, 12% say they have $500,000 to $999,999 saved, and 13% say they have $1,000,000 or more in retirement savings. Seven percent of this group say they have no money saved for retirement.

But is there a rule of thumb for how much money a person should save to retire comfortably? Moore says the amount a person should strive to save depends on their goals and other factors, like how long do they have before they retire, how much social security they will receive, and if they have other retirement income sources like a pension. “There are popular rules of thumb out there, such as the 4% rule or needing to save 25 times your annual spending before you retire, but these rules have their flaws. It’s important to work with a financial advisor to discuss your unique situation and goals to determine the amount you need to save,” says Moore.

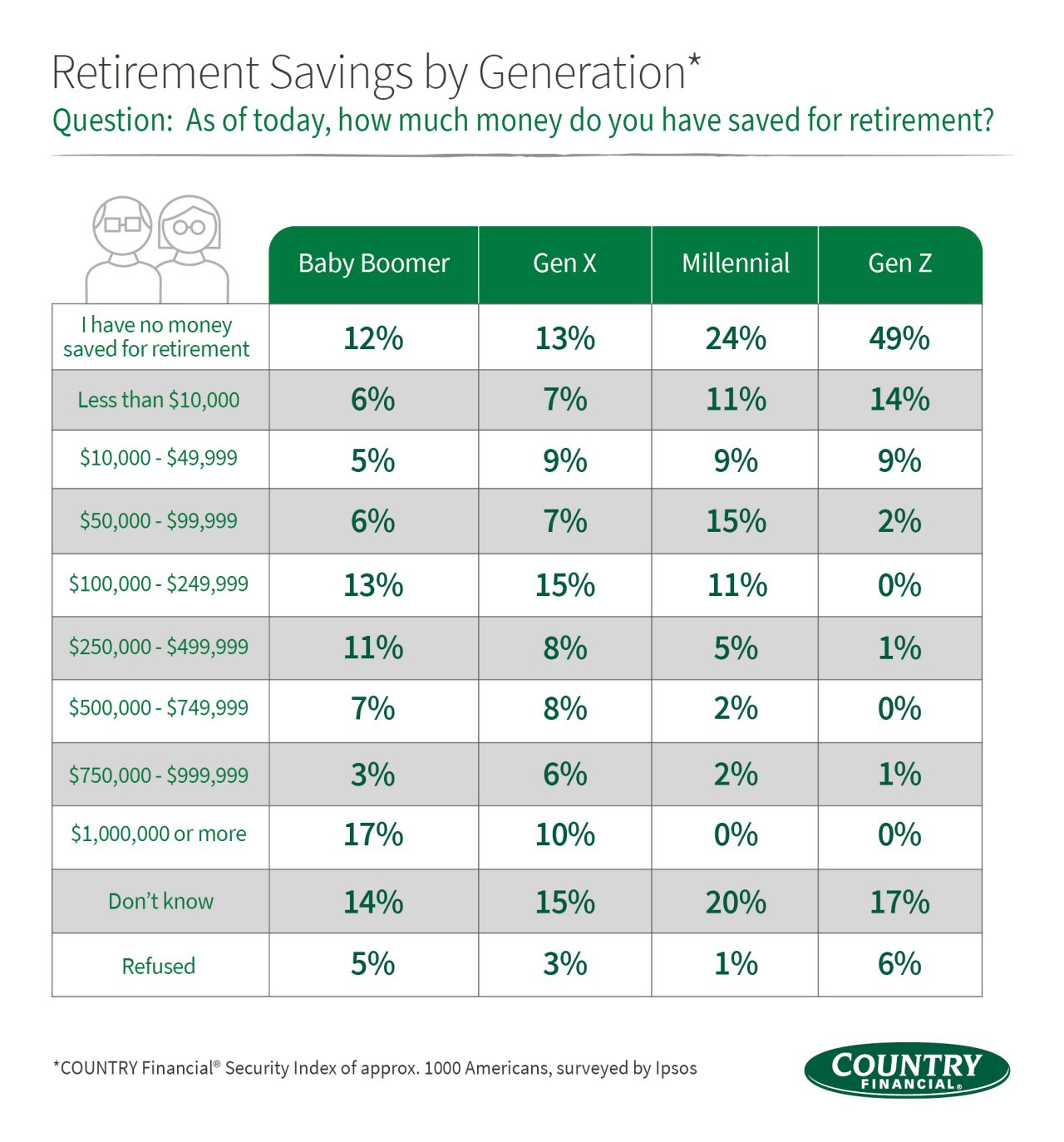

Retirement savings by generation

Not surprisingly, age and the amount of time a person has before retiring play an important role in their expectations and confidence. Older generations are more confident that they will have enough money to retire (Baby Boomers 74% and Gen X 60%) than their younger counterparts (Millennials 54% and Gen Z 47%).

Older generations are also more likely to say that they were able to set aside money for savings and investments in the last two months. Six in ten Baby Boomers and Gen Xers were able to save, vs. half of Millennials and 45% of Gen Z.

Moore says that COUNTRY clients who have been able to retire comfortably have many approaches in common. “First, they have been consistent in their saving and investing efforts for many years. Second, they have been able to moderate their retirement spending needs by managing their cash flow properly, doing things like paying off debts and not over-extending themselves. They often have sources of lifetime guaranteed income, such as an employer pension, and they have probably made some smart investment decisions.”

Moore reminds retirees that their work isn’t done when they retire. “If you want to stay confident and comfortable throughout retirement, it’s important to work closely with a financial advisor to navigate the decumulation phase. A mistake in this phase can be costly or even detrimental to your retirement.”

Media contact

COUNTRY Financial® is a family of affiliated companies (collectively, COUNTRY) located in Bloomington, IL. Learn more about who we are.

COUNTRY Financial® is the marketing name for the COUNTRY Financial family of affiliated companies (collectively, COUNTRY), which include COUNTRY Life Insurance Company®, COUNTRY Mutual Insurance Company®, and their respective subsidiaries, located in Bloomington, Illinois.

About the COUNTRY Financial Security Index®

Since 2007, the COUNTRY Financial Security Index has measured Americans' sentiments of their personal financial security. The Index also delves deeper into individual personal finance topics to better inform Americans about the issues impacting their finances.

The COUNTRY Financial Security Index was created by COUNTRY Financial and is compiled by Ipsos an independent research firm. Surveys were conducted using Ipsos' KnowledgePanel®, a national, probability-based panel designed to be representative of the general population and includes responses from approximately 1,026 U.S. adults for national surveys. The margin of sampling error for a survey based on this many interviews is approximately +/- 3.3 percentage points at the 95% confidence level.

About COUNTRY Financial®

The COUNTRY Financial® group (www.countryfinancial.com) serves about one million households and businesses throughout the United States. It offers a wide range of financial products and services from auto, home, business and life insurance to retirement planning services, investment management and annuities.

Visit COUNTRY Financial on X @HelloCountry, on Facebook @COUNTRYFinancial and on Instagram @countryfinancial.

About Ipsos

Ipsos is the world's third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).